By Christopher J. Ryan, Jr. & Brian L. Frye*

Download a PDF version of this article here

Introduction

Since in the last quarter of the 20th Century, the United

States patent system has been in a state of flux, influencing not only patent

law but the incentives underlying invention and patent ownership. A series of

legislative acts and judicial decisions, beginning in 1980, have affected the

ownership, scope, and duration of patents. In 1980, the Bayh-Dole Act enabled

academic institutions to patent inventions created from federally-sponsored

research.[1] In 1994, Congress

extended the maximum duration of a United States patent from 17 to 20 years for

certain patents, increasing the monopolistic value of patent protection.[2] And in 2011, the

America Invents Act shifted the patent system from a first-to-invent standard

to a first-to-file system.[3] These changes have impacted

all inventors but especially those at academic institutions, where research is

a multi-billion dollar industry; perhaps relatedly, these changes have

coincided with historic increases in patent activity among academic

institutions.

This patent activity is not necessarily unexpected,

inefficient, or objectionable. After all, academic institutions are charitable

organizations and intended to promote the public good of innovation, among

other things. Many academic institutions, especially research universities,

rely on significant federal investment to support research that promotes the

dissemination of knowledge, disclosure of new knowledge, and importantly,

innovation. In theory, the patent system could do even more to encourage

academic institutions to invest far greater resources in innovation.

However, university patent activity has important economic

and normative implications. The patent system uses private economic incentives

to promote innovation. Accordingly, it creates an incentive for universities to

overinvest in patentable innovation and limit access to innovation, in order to

internalize private economic value. This is especially troubling because

universities may use publicly-funded research to generate patentable

innovations for private gain. Thus, concerns about transparency and efficiency arise

when considering the extent from which universities may ultimately derive private

monetary benefit from public investment, especially given that universities

lack the capacity to bring an invention to market.[4] That is, as a non-practicing entity,

in order to internalize the economic value of their research, universities must

acquire patent protection over their inventions. However, because they do not

have the capacity to bring their inventions to market, universities can and do

use public funds to produce research yielding patents that are worthless or,

worse yet, transfer their patents rights to patent assertion entities rather

than practicing entities, producing externalities and inefficiency in the

patent system.[5]

While the purposes of the patent system are manifold, these

sorts of behaviors undercut the argument that patents contribute to innovation.

Thus, there is a founded concern that academic institutions have responded to

patent incentives in ways that may actually limit access to innovation. Yet,

this concern is not the only cause for unease about inefficient responses to

patent incentives.[6] For example, most

of the patent infringement actions heard in a handful of district courts that have

been described as engaging in forum selling—being a friendly forum for cases filed

by patent assertion entities that choose the forum based on its pro-plaintiff

bias.[7] Many observers are concerned that

the concentration of patent assertion activity in certain district courts has

increased the cost of innovation.[8]

Similarly, there is legitimate concern that universities contribute

to cost and inefficiency by: (1) using public funds to support research that

results in often useless patents; or (2) providing the instrumentality for

non-practicing entities to increase the cost of innovation. That is,

universities may participate in driving up the cost of innovation by

aggregating patent protection for inventions that are likely to have little

market value or that they cannot bring to market and must transfer, even to

other non-practicing entities. This article is the first in a series of papers

to investigate the relationship between universities and the patent system. In

particular, this article addresses whether universities can be said to

aggregate patent protection for their inventions systematically or

monopolistically, which may indicate their role in increasing the cost of

innovation. The discussion and results, below, suggests that academic

institutions have responded to patent policy changes not in a manner consistent

with firm behavior, by accruing property rights when incentivized by patent policy

changes to do so, but also by strategically holding out in order to reap

greater monopolistic benefit under anticipated patent regime changes, which may

have exacerbated the problem of increasing the cost of innovation.

I. The Patent System

The purposes of the patent system are several, but the

primary purpose is to promote technological innovation, or rather, to “promote

the Progress of . . . useful Arts, by securing for limited Times to . . .

Inventors the exclusive Right to their respective . . . Discoveries.”[9] While some scholars

have questioned the efficiency of the patent system, and other scholars have

suggested that it may only provide efficient incentives in some industries,

conventional wisdom assumes that it is generally efficient, providing a net

public benefit by encouraging investment in innovation.[10] In any case, while

the patent system has always provided essentially identical incentives to

inventors in all industries, the demographics of patent applicants and owners

have changed over time. Originally, many patent applicants and owners were

individual inventors, but for quite some time, the overwhelming majority of

patent applicants and owners have been both for-profit and non-profit corporations.

An increasing number of those corporate patent applicants and owners are

academic institutions.[11]

A. Academic Patents

Academics have always pursued patents on their inventions

with varying degrees of success. But academic institutions did not meaningfully

enter the patent business until the early 20th century, and even then, they did

so only tentatively.[12] In 1925, the

University of Wisconsin at Madison created the first university patent office,

the Wisconsin Alumni Research Foundation, an independent charitable

organization created in order to commercialize inventions created by University

of Wisconsin professors. Similarly, in 1937, MIT formed an agreement with

Research Corporation, an independent charitable organization, to manage its

patents.[13] Many other schools

followed MIT’s lead, and Research Corporation soon managed the patent

portfolios of most academic institutions.[14]

Before the Second World War, academic institutions engaged

in very limited patent activity, collectively receiving less than 100 patents.

But during the war, many academic institutions adopted formal patent policies,

typically stating that faculty members must assign any patent rights to the

institution.[15] Gradually, some academic

institutions began creating their own patent or “technology transfer” offices.

But by 1980, only 25 academic institutions had created a technology transfer

office, and the Patent Office issued only about 300 patents to academic

institutions each year.[16]

Since then, patent law has increasingly encouraged patent

activity at academic institutions. Until 1968, each federal agency that

provided research funding to academic institutions had its own patent policy.

Some provided that inventions created in connection with federally funded

research belonged to the federal government, others placed them in the public domain,

and a few negotiated institutional patent agreements with academic

institutions, allowing them to own patents in those inventions. In 1968, the

Department of Health, Education, and Welfare’s introduced an Institutional

Patent Agreement, allowing for non-profit institutions to acquire assignment of

patentable inventions resulting from federal research support for which the

institution sought a patent. However, this policy was not uniformly applied. As

such, in 1980, under pressure to respond to the economic malaise of the 1970s, Congress

passed the Bayh-Dole Act, which enabled academic institutions to patent

inventions created in connection with federally-funded research.[17] Specifically, the

Act provided that, with certain exceptions and limitations, “a small business

firm or nonprofit organization&rdquo could patent such inventions, if the

organization timely notified the government of its intention to patent the

invention and gave the government the right to use the invention.[18] The Act placed

certain additional requirements on nonprofit organizations, providing that they

could only assign their patents to an organization whose primary function is to

manage inventions. Additionally, the nonprofit organizations must share any

royalties with the inventor and use the earned royalties only for research or

education. The limitation on assignment was intended to encourage academic

institutions to assign their patents to charitable organizations, like Research

Corporation, but in practice, it led many of them to compete over federal funds

only to produce patentable inventions with little value or to assign their

patents to patent aggregators or &ldquopatent assertion entities.&rdquo[19]

At about the same time, the scope and duration of patent

protection began to expand. First, the Supreme Court explicitly expanded the

scope of patentable subject matter to include certain genetically modified

organisms and computer software.[20] Then, in 1982,

Congress created the United States Court of Appeals for the Federal Circuit,

which has exclusive jurisdiction

over patent cases and has adopted consistently pro-patent positions.[21] In 1984, Congress

expanded the patentability of pharmaceuticals.[22] In 1994, Congress

ratified the Uruguay Round of negotiations which created the World Trade

Organization and extended the maximum duration of a United States patent from

17 years from the date of issue to 20 years from the filing date, marginally increasing

the value of a patent.[23] And in 2011,

Congress passed the Leahy-Smith American Invents Act, which amended the Patent

Act by, inter alia, moving from a

first-to-invent to a first-to-file patent system.[24]

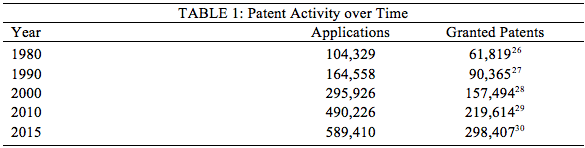

All of these changes in patent protection caused an increase

in overall patent activity, across all types of inventors.

That said, academic institutions

played a role in the growth of nationwide patent activity directly related to

the dramatic increases in patent applications and grants between 1980 and 2010.

In response to these policy changes, many universities adopted a research model

under which federal grants and other public funds were directed at the

development of patentable inventions and discoveries, enabling the universities

to obtain patents and claim a private benefit. By 1990, more than 200 academic

institutions had created technology-transfer offices, and the Patent Office was

issuing more than 1,200 patents to academic institutions each year.[30] In 1995,

universities received over $15 billion in research grants from the federal

government, a figure that would more than double—$35.5 billion—by 2013.[31]

Ironically, while some of the patents granted to academic

institutions proved extremely valuable, the overwhelming majority of them are

worthless. Most of the technology-transfer offices created by academic

institutions produce little revenue when compared with expenditures, and many

actually lose money.[32] In 2013, the

median value among universities reporting revenues from their technology

transfer offices was a mere $1.57 million; moreover, less than 1 percent of all

patent licenses for patents held by universities and their technology transfer

companies generate revenues reaching or exceeding $1 million.[33]

B. An Economic View of Patents

The prevailing theory of patents is the economic theory,

which holds that patents are justified because they solve market failures in

innovation caused by free riding. In the absence of patents, inventions are

“pure public goods,” because they are perfectly non-rivalrous and nonexcludable.[34]

Neo-classical economics predicts market failures in public goods, because free

riding will prevent marginal inventors from recovering the fixed and

opportunity costs of invention.[35] Under the economic

theory, patents solve market failures in innovation by granting inventors

certain exclusive rights in their inventions for a limited period of time,

which provide salient incentives to invest in innovation.[36]

Patents may also cause market failures by granting

inefficient rights to inventors and imposing transaction costs on future

inventions.[37] In theory, patent

law can increase net economic welfare by granting patent rights that are salient

to marginal inventors and encourage future inventions. In practice, however,

patent law may grant rights that are not salient to marginal inventors and

discourage future inventions. For example, patent law may cause market failures

by discouraging marginal inventors from investing in innovation.

The American patent regime has precipitated “arms race” and

“marketplace” paradigms, both of which elicit firm behavior.[38] In the first

instance, the benefits of patent protection incentivize innovators to aggregate

under the auspices of the firm model, thereby reducing the marginal cost to

each innovator of producing patentable technology. The marketplace paradigm

encourages innovation, or at least innovation likely to result in patent

protection. Both paradigms, however, are subject to the results of the perverse

incentives that the patent regime provides, specifically that of patent

stockpiling and the rent-seeking behaviors of non-practicing and patent

assertion entities.[39]

The right to exclude is perhaps the most important stick in

the bundle of patent protection rights and may have the effect of stifling

rather than promoting innovation.[40] As the ubiquity of non-practicing

and patent assertion entities in the patent market become commonplace, patent

holdup, patent litigation, and patent thickets are common features of the

modern patent marketplace.[41]

C. University Responses to Patent Policy Incentives

From the perspective of the theoretical

literature, innovation depends upon innovators receiving the benefits of their

innovation; the regime that allocates these benefits to the innovator and

thereby incentivizes innovation is the most efficient.[42]

For universities, a majority of which relied on federal funding to support

research and development of patentable innovation during the 20th Century, the

patent regime did not substantially encourage universities’ entry into the

patent market until the passage of the Bayh-Dole Act in 1980.[43] Descriptive research

in this area suggests that the Bayh-Dole Act—which allowed universities to

patent inventions developed in connection with federally-funded

research—increased the number of university participants in the patent market.[44] Some scholars have

also attributed university technology transfer and patent title aggregation as

being rooted in the Bayh-Dole Act.[45]

However, these developments point to the fact that

universities may be responding to policy interventions—such as the extension of

the duration of patents in 1995 and anticipation of the America Invents Act—and,

in turn, affecting the patent landscape.[46] Examples of these

responses include shifting investment in research and development toward

innovation sectors that are more likely to receive patent protection,

particularly those with high renewal rates, and because the US Patent and

Trademark Office (PTO) derives more revenue from these sectors, it has the

incentive to grant applications from high renewal rate sectors.[47] Additionally,

researchers have noted that the patent regime does not privilege economic

development through technological transfer, and may account for both the

increase in patent litigation from non-practicing entities, such as

universities, as well as rise in rent-seeking behaviors in patent licensing.[48]

University technology transfer forces academic institutions

to make uncomfortable decisions about licensing and litigation.[49] Many academic

institutions have responded to this ethical dilemma by assigning their patents

to patent assertion entities in order to obscure their relationship to those

patents and avoid the obligation to enforce them.[50] Despite

universities’ status as charitable organizations, as patent owners they have a

financial incentive to support their research and development enterprises by

competing for federal grants, even if it results in patentable inventions for

which there is little economic value and limit the use of the knowledge they

generate by securing patent rights regardless of whether these inventions have

economic value. Either of these scenarios exacerbates the cost of innovation.[51]

D. The University as a Firm

In response to the changes in the

patent law system between 1980 and 2011, especially the Bayh-Dole Act, academic

institutions increasingly adopted a research funding model under which federal

research grants and other public funds were focused on the development of

patentable inventions.[52] As previously

observed, the total number of patents granted by the Patent Office steadily

increased, and so did the percentage of those patents granted to academic

institutions.[53] Soon, participants

in the patent law system began expressing concerns about entities that

decreased the efficiency of the patent system by merely owning and asserting

patents, rather than practicing them. Of course, academic institutions that own

patents are non-practicing entities almost by definition, as they exist to

create and disseminate knowledge, not produce commercial products.[54] Even more

troubling, many academic institutions assign most or all of their patents to

patent assertion entities, the paradigmatic patent trolls. As a result, the way

that academic institutions use patents presents a risk of creating “patent thickets

that entangle rather than encourage inventors,” which is in tension with the

charitable purpose of those institutions.[55]

But how did these patent thickets sprout from the soil of

the university? The behavioral theory of the firm may help explain why academic

institutions responded to incentives created by changes in this way. Unlike

neoclassical economics, which uses individual actors as the primary unit of

analysis, the behavioral theory of the firm uses the firm itself as the primary

unit of analysis. As a consequence, the behavioral theory of the firm provides

better predictions of firm behavior with regard to

output and resource allocation decisions.

The field of organizational economics emerged in 1937, when

Ronald Coase observed that firms emerge when the external transaction costs

associated with markets exceed the internal transaction costs of the firm.[56] Coase’s theory of

the firm was revolutionized in 1963, when Richard Cyert

and James March provided a behavioral theory of the firm, observing that firms

consist of competing coalitions with different priorities responding to

different incentives.[57]

In the context of funded

research, university patent activity can be read as the result of strategic

firm decision-making regarding patent output and resource allocation decisions.

In fact, the way that patent policy has bent toward

rewarding university patent activity through conferral of rights is a direct

result of lobbying and decision-making efforts by these universities with

lawmakers—evidence of the bidirectional interaction between universities and

external influences.[58] The behavioral theory of the firm suggests that

academic institutions have responded to incentives created by patent law in a

manner consistent with firm behavior.[59] Though heterogeneity of university patent

activity does exist, at most intensive research

universities, where decisions are made two ways—with executive administrators

setting strategic goals for research which are then implemented at lower

management levels—intense competition exists between intensive research

universities to vie for patent rights and thus profit maximization.

Increasingly, these universities have centralized and ceded

title in patents to their foundations and technology transfer offices.[60] As non-practicing

entities, universities bear the transaction costs of developing patented

inventions, but they transfer the transaction costs of bringing the invention

to market to intermediaries—and get paid for doing so.[61] As a consequence,

the goal of a university is to satisfice rather than maximize results; firms

typically focus on producing good enough outcomes, rather than the best

possible outcomes, as a function of compromise among internal coalitions with

different priorities.

Thus, one could view increased

activity immediately after the implementation of a policy conferring greater

patent rights not as a random but as a very rational, profit-maximizing response.

However, this activity presents issues when the firm actor is a university.

Because academic institutions are necessarily non-practicing entities with

strong incentives to assign their patents to patent assertion entities in order

to extract their economic value—yet the research from which a patentable

invention derives is funded largely by public, federal investment—the gray area

which universities occupy through their patent activity makes clear that, while

they might not be “patent trolls” as Mark Lemley

argues, they certainly feed the patent trolls.[62]

This article aims to provide

evidence of that very point. As scholars, like Jacob Rooksby,

have observed: “[t]he accumulation, use, and

enforcement of intellectual property by colleges and universities reflects

choices to engage in a system that . . . takes knowledge and information that

is otherwise subject to . . . public use and restricts it, by attaching private

claims to it.”[63] The result of these restrictions produced by

universities’ firm behavior through their patent activity and transfer carries

real consequences for innovation. While the effects of these consequences are

uncertain, the inputs are fairly clear: the prospect of wealth-maximizing

motivates activity in university technology transfer.[64] Yet, the relationship between universities’

wealth-maximizing foray into patent acquisition and its connection with patent

policy changes, as well as the explanatory theoretical framework of the

behavioral theory of the firm for this very sort of activity, have not been

established heretofore. In the sections that follow, this article makes this

connection with supporting empirical analysis.

II. Empirical Analysis

A. Research Questions

While academic institutions have responded to patent

incentives in a manner consistent with firm behavior, the optimal firm response

does not necessarily produce the optimal social outcome. Organizational

economics predicts that firms will respond to external incentives by

satisficing results consistent with the consensus of internal coalitions. As a

consequence, firms may or may not respond to patent incentives in a manner

consistent with the patent system’s goal of maximizing innovation. It follows

that if academic institutions exhibit firm behavior in relation to patent incentives,

they may satisfice internal coalitions at the expense of social welfare. In the

context of university patent activity, this behavior could take the form of the

pursuit of patent acquisition not because it is a wealth-maximizing or an

economically efficient activity but simply because the regulatory conditions

are preferable to pursue patent acquisition.

This study asks whether and how changes in patent law have

affected the patent activities of academic institutions. Specifically, it asks

two questions:

To what extent do

universities change their patent acquisition strategy in response to changes in

patent law?

To what extent do

different kinds of universities respond differently to changes in patent law?

To answer these questions, this study analyzes data on the

population of academic institutions that were granted one or more patents

between 1969 and 2012 in order to determine the impact of policy changes on

university patent activity over this time.[65] Notably, while

future papers in this series may engage with such questions, this article does

not determine whether academic institutions have responded to changes in patent

law in a way that increases or decreases net social welfare. But it can help

explain how academic institutions have responded to patent incentives and

whether their responses are consistent with firm behavior, laying the

foundation for future exploration of whether and how universities may play a

role of increasing costs to innovation.

B. Data

This study relies primarily on a valuable, albeit limited,

dataset compiled by the PTO, which records the total number of patents granted

per year to each educational institution in the United States between 1969 and

2012.[66] Because of

limitations with this data—for example, the data contain only one measured

variable, the total number of patents granted to an institution in a calendar

year—this dataset had to be merged with other datasets to include more

explanatory variables for each institution observation over the same length of

time. Specifically, this study relied on the available data from the

Classifications for Institutions of Higher Education, a Carnegie Foundation

Technical Report, which was produced in 1973, 1976, 1987, 1994, 2000, 2005, and

2010.[67] Because the first

three published Carnegie Classification reports—1973, 1976, and 1987—have not

been digitized, the use of this data required the authors to hand-code the

classification for each observation utilized in the analytical sample.

From the merged dataset, consisting of the full population

of higher-education-affiliated institutions that had been granted a patent

between 1969 and 2012, an analytical sample had to be drawn from this

population to focus on the main university participants in the patent market:

research universities; doctoral-granting universities; medical, health, and

engineering specialized institutions; and to a lesser extent, comprehensive

universities; liberal arts colleges; and other specialized institutions,

including schools of art, music, and design, as well as graduate centers,

maritime academies, and military institutes.[68] Due to the paucity

of observations in the following subgroups, 31 observations from two-year

colleges, corporate entities, and spin-off research institutes were dropped

from analysis, preserving 591 university observations. Additionally, given that

the University of California system does not differentiate patent activity by

institution, choosing instead to have reported patent activity in the aggregate

in the PTO dataset, it was removed from the analytical sample.

Because the Carnegie Classifications attribute most

administrative units to the parent institution, this study took the same

approach, collapsing administrative units, foundations, other organizational

entities, and former institutions on the current parent institution. However,

each observation that received a separate classification from its parent

institution in the Carnegie Classifications was preserved as a separate

observation from the parent institution.[69] The process of

collapsing on parent institution reduced the total number of institutions

observed from 590 to 366 school observations, each with 44 year observations.

C. Limitations

It should be noted that the data are limited by two

important factors: (1) a lack of explanatory covariates; and (2) a small sample

of higher education institutions relative to the overall population of higher

education institutions. In the first instance, because the year observations

for each institution comprise a 44-year span, it is impractical to match each

institution-year observation with rich, explanatory covariates over that time.

Not even the Integrated Postsecondary Education Data System (IPEDS) collected

comprehensive data on universities before 1993. As such, the Carnegie

Classifications serve as a proxy for more detailed information about each

institution during a span of years for which data is virtually impossible to

find. Given that the Carnegie Classifications categorizes schools on the basis

of its federal funding for academic research, production of doctorates,

institutional selectivity, enrollment, and degree programs, the Carnegie

Classification for each school makes an ideal proxy for a more complete set of

explanatory covariates.

As for the size of the analytical sample relative to the

population of institutions of higher education receiving a Carnegie

Classification since 1973, this population consisted of 1,387 universities—not

counting theological seminaries, bible colleges and two-year colleges—while the

analytical sample used in this study comprises 366 universities—26.39 percent

of the population. However, because this study analyzes university patent

activity relative to patent policy change, the analytical sample size is

necessarily limited to only those universities that have been granted a patent.

As such, the analytical sample used in this study can be viewed as representing

a nearly complete picture of the population of academic institutions that have

successfully engaged in patent activity between 1969 and 2012.

D. Descriptive Results

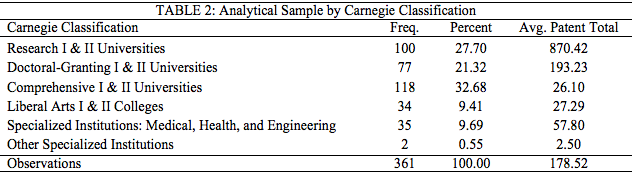

Research universities and doctoral-granting universities

dominate patenting activity and receive an overwhelming majority of patents

granted to academic institutions.

However, just under half of the analytical sample is

comprised of research universities and doctoral-granting universities, which

the Carnegie Classifications consider separate but component parts of its

doctoral-granting institution category. The average patent totals for research

universities dominate all other classification of institution and are over four

times as large as the average patent total for doctoral-granting universities.

While comprehensive universities account for the largest proportionate

classification in the sample, the average patent total for comprehensive

universities is among the smallest in the analytical sample. In fact, it is

followed only by the smallest classification in proportion and average patent

total—other specialized institutions. Medical, health, and engineering schools,

while small in number, maintain considerable average patent totals, nearly

doubling the patent totals of liberal arts colleges which account for about the

same proportion of institutions analyzed in the analytical sample. Across all

categories, universities that entered the patent market before the passage of

the Bayh-Dole Act buoy patent totals. As such, given their high level of patent

activity, the spline regression model results below will especially highlight

early entrants as well as research universities, doctoral-granting

universities, and medical, health, and engineering schools.

E. Research Method and Model

This study employs a spline regression approach to identify

how universities reacted to changes in patent policy at key points in time

between 1969 and 2012. This method is very similar to using a

difference-in-differences approach to compare the activity differences between

two series of years separated by a point, or knot, in

time, where the intercept and slope vary before and after the knot.[70] Spline regression

modeling necessitates that the location of the knots be set a priori in order to produce estimates

of the non-linear relationship between the predictor and response variables.

Doing this requires defining an indicator variable, using it as a predictor,

but also allowing an interaction between this predictor and the response

variable.[71] The analytical

model employed in this study is as follows:

Thus, the expectation of the total number of patents granted

to school i

(PATi)

in year t (yrt) is a function of:

(1) a vector of the factors attendant to school i in year t as proxied by its Carnegie

Classification (CCit);

(2) a dummy variable for whether or not the school engaged in patent activity

before 1980 (EEi);

(3) a school fixed effect (Si);

(4) the year indicator variable (yrt); (5) a dummy variable for the location of

the indicator year between the critical spline knots (kc, kc-1);

(6) the interaction of the indicator year and the dummy variable for its

location between the critical spline knots; and (7) the random error term (eit).

Spline knots were set at 1981 (k1), 1996 (k2),

and 2010 (k3) to account

for: (1) the passage of the Bayh-Dole Act in 1980, which incentivized

universities to engage in patent activity by giving them title to inventions

produced from federally-funded research; (2) the expansion of the patent

protection duration from seventeen to twenty years in 1995; and (3) the

introduction of the America Invents Act, which would pass into law in 2011 and

change the right to the grant of a patent from a first-to-invent standard to a

first-inventor-to-file standard.[72] The final spline

knot was not set at 2012 for two reasons. First, because 2012 was the final

year of observation in the data set, the spline regression model would not

tolerate a post-2012 slope prediction without post-2012 data. Additionally,

setting the knot at 2012 would not account for the possibility that

universities may have begun reacting to the policy before the effective date of

the policy change, as this particular policy change was in the offing for several

years before its eventual passage.

From a theoretical perspective, the decision to specify the

analytical model with year-after-the-intervention spline knots is defensible on

the grounds that it allows an additional calendar year for universities to

react to the policy intervention. However, to test the sensitivity of the model

and the decision to set the spline knots one year after the policy

intervention, the model was specified in multiple formats to include spline

knots on the year of the policy intervention, one year before the policy

intervention, and two years before the policy intervention. This sensitivity

test was undertaken to ensure that the differences in slopes and intercepts

throughout year observations were not evidencing a secular exponential curve.

Although the year-of-the-intervention slopes and intercepts bore marginal

similarities to the results discussed below, which are modeled on

year-after-the-intervention spline knots, there were significant differences

between the year-after-the-intervention slopes and intercepts reported below

and those for year-prior- and two-years-prior-to-the-intervention. Thus, the

year-after-the-intervention spline knot specification used in this study is

preferable to other specifications, because it rules out the potential threat

of secular trends.

F. Empirical Results

To analyze the effect of the patent

policy changes on university patent activity, the regression model provided in

the section above was used to calculate both the intercept before and after the

policy intervention as well as the slope before and after the policy

intervention. Given that the model employed a fixed effect by institution, the

regression results reported below can be interpreted as providing an estimate

of the intercepts (I) and effects, or slopes (E) pre-intervention, as well as

the marginal intercept shift and slope change after the intervention for

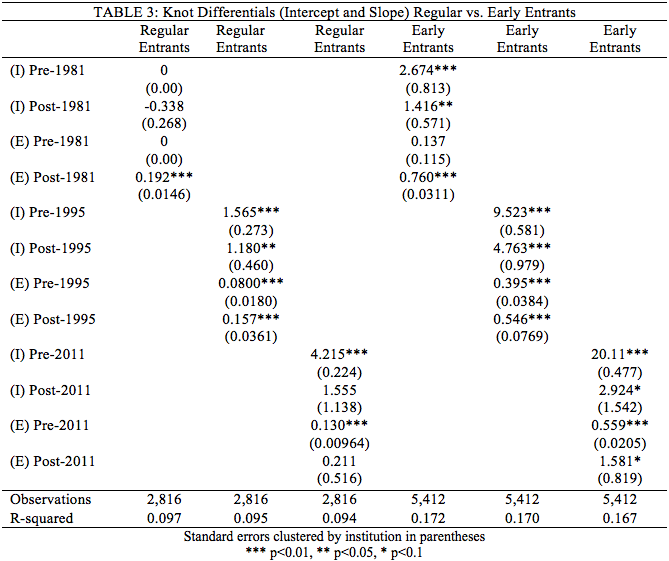

universities in the analytical sample. In the first regression table, Table 2,

the results compare early entrants to non-early entrants, demonstrating stark

differences between the two groups.

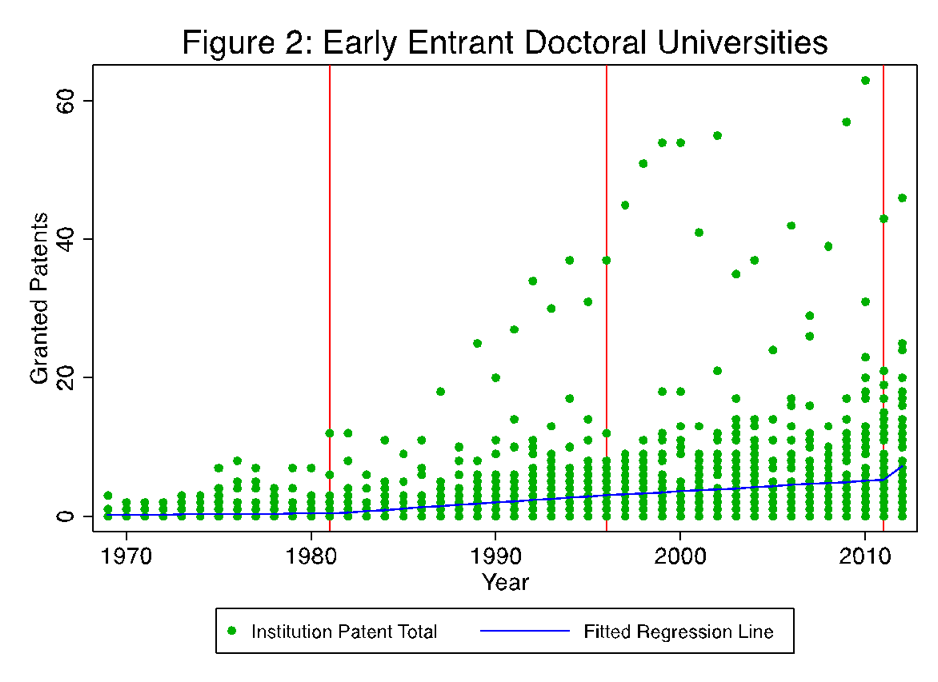

Notably, the early entrants engaged in patent activity at a

modest but steady rate, adding minimally to yearly patent totals and averaging

2.67 patents granted annually by 1980. In 1981, the intercept at this spline

knot jumped by an average of nearly one and a half patents in a single year,

with an accelerated slope adding to the average growth by three-quarters of a

patent every year thereafter to 1994. By 1995, the intercept spiked again, this

time by an additional 4.76 patents granted annually for early entrants, with

even further accelerated slope gains to 2010. Finally, in 2011, thought they

came close, the estimates lacked statistical significance at the p<0.05

level but indicated an added intercept bump and positive explosion in slope.

The non-early entrant estimates, though mostly consistent with the statistical

significance of the early entrant estimates for the same periods, pale by

comparison. The direction and statistical significance of the results for all

early entrants are fairly consistent with estimates for the effect of policy

changes at the 1981, 1995, and 2011 spline knots among early entrants in the

research and doctoral-granting universities classifications.

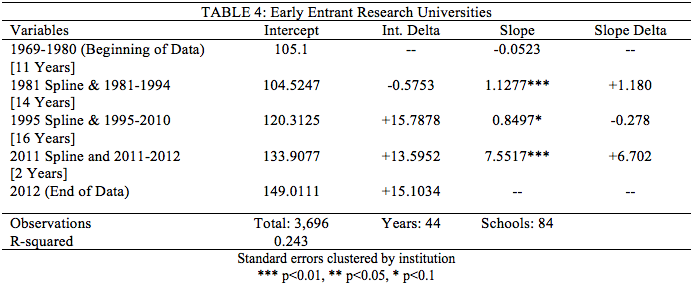

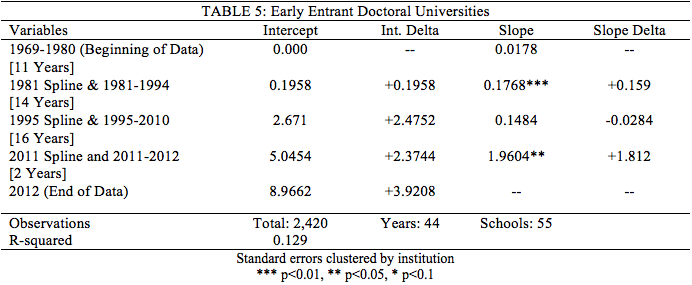

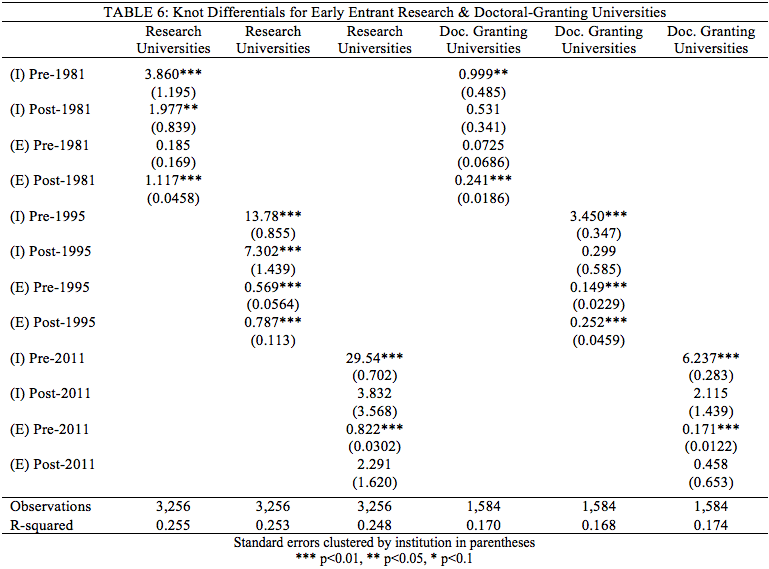

The results provided in Tables 3 and 4 describe patent

activity among early entrant research and doctoral universities, respectively.

As Table 3 indicates, research universities achieve the greatest orders of

magnitude of increased patent grants at the regression spline knots. Slope

changes among this group are statistically significant (or very closely

approaching significance in the case of the 1995 spline), illustrating the

differential response within group to the various policies while mitigating the

influence of secular trends.

Doctoral-granting institutions

maintained relatively flat—until 2011, when the slope dramatically and

significantly changed—but exhibit consistent growth in patent activity around

the spline knots.

Table 5 compares the activity among these two early entrant

groups in terms of patents granted. Before the passage of the Bayh-Dole Act in

1980, research universities engaged in steady, relatively flat rates of patent

activity, averaging about four patent grants per year. In 1981, the intercept

for research universities increased by an average of about two patent grants,

significantly adding an average of more than one patent grant per year

thereafter. In 1995, the research university intercept jumped over seven units

but had a relatively stable slope before and after this time. While the limited

data after 2011 do not tolerate statistical significance, research universities

and doctoral-granting universities may have undergone another upward intercept

shift, but more importantly, may have also undertaken a momentous slope shift,

relative to all other slope shifts observed by category, in the years since

2011.

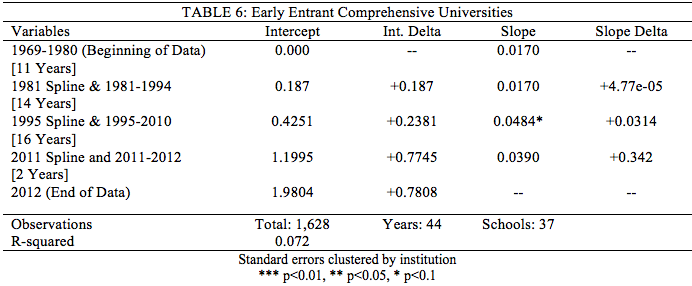

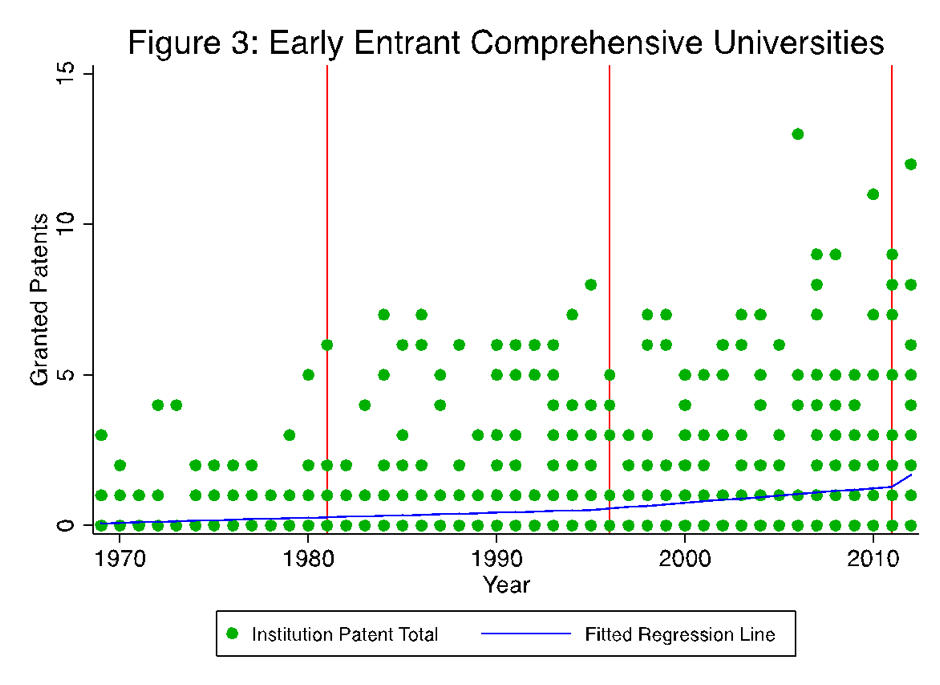

Among early entrant comprehensive universities, only one

spline knot approaches statistical significance—the knot at 1995—but even it

represents a modest increase from preceding patent activity.

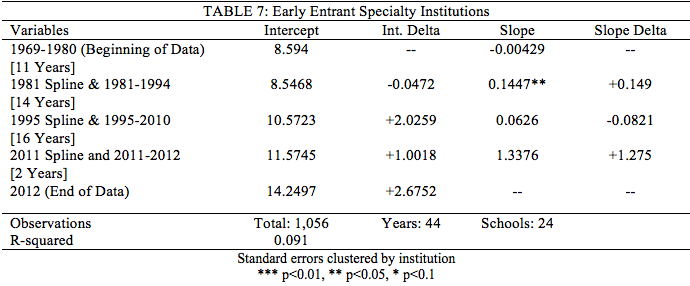

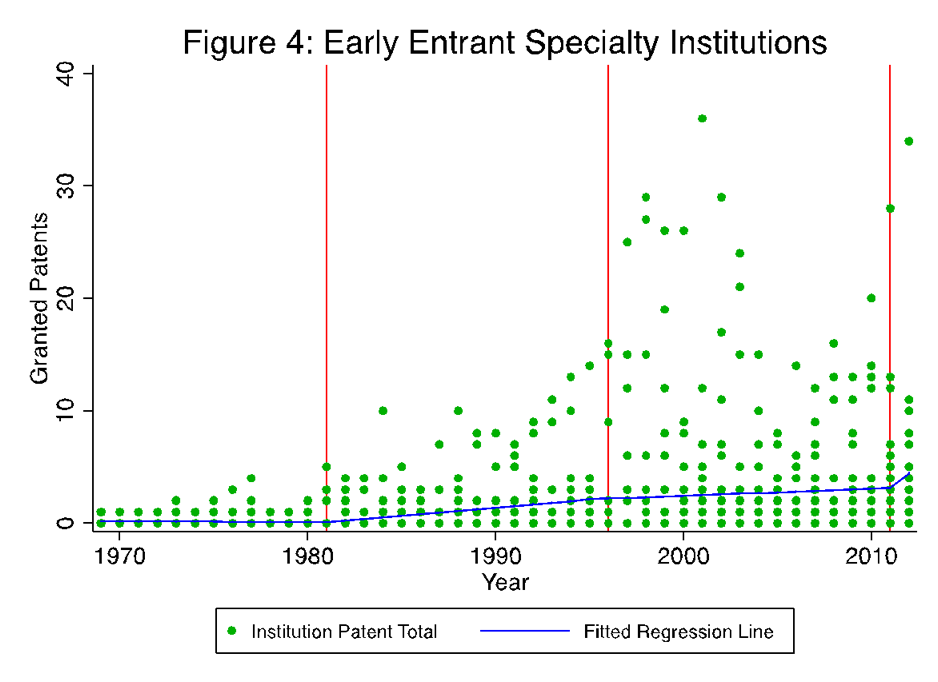

Likewise, the statistical

significance of the specialty institutions’—including primarily medical,

health, and engineering schools—spline knot estimates is only present around

the 1981 spline knot. Yet, the results clearly indicate a considerable bump at

the 2011 spline knot, despite the lack of statistical significance at that

spline or the 1995 spline.

It is likely that these two groups of

institutions—comprehensive universities and specialty institutions—demonstrate

relatively little change with the passage of new patent policy for a couple of

reasons. First, their numbers are few, especially when compared with research

and doctoral-granting universities. Second, and perhaps more important, their

missions are very different from research universities.[73] Thus, these

universities may not respond to the same incentives in the same way as research

and doctoral universities simply because research resulting in a patent may not

be an institutional priority for many of the schools in the comprehensive and

specialty institution categories.

Notwithstanding these results for the comprehensive

universities and specialized institutions, the statistically significant slope

and intercept differentials, while controlling for explanatory covariates,

indicate the strong presence of university patent activity responses among

research and doctoral universities to patent regime changes at the years

represented by the spline knots. There is considerable evidence that, among

these two categories of universities, the passage of the Bayh-Dole Act in 1980

provided considerable incentive, and elicited considerable effect, on the

engagement of major universities in patent acquisition. The shrinking but still

significant effect at the 1995 policy intervention, which extended patent

duration to 20 years in some but not all patents, may be direct evidence that,

because this policy change was not as major a shift in the conferral of rights

to universities, it did not elicit the same magnitude of response. However, the

anticipation of the passage of the America Invents Act triggered a massive

shift in university patent acquisition, perhaps because universities were

concerned that their inventions could be scooped under the new

first-inventor-to-file standard.

This behavioral pattern suggests a rational,

profit-maximizing response—the result of strategic

firm decisions regarding patent output and resource allocation decisions—to

increase patent activity immediately after the implementation of a policy

conferring greater patent rights. However, because universities do not bring

these patents to market themselves, and so many of these patents are sold to

patent assertion entities, the increase in university patent activity has the

effect of contributing substantially to the patent thicket.

Conclusion

This study asks whether universities exhibit patent activity

consistent with firm behavior. The results of the spline regression models

suggest that research universities and doctorate-granting universities increase

their patent activity in direct response to incentives created by changes in

patent law but may also strategically hold on to pursue patentable inventions

until after the policy provides them more robust patent rights or protection.

Most notably, across all university types, the Bayh-Dole Act accelerated patent

activity once universities could take title in inventions produced from

federally-funded research. As illustrated in the regression models and Figure 1

in the Appendix, this Act may have even incentivized research universities to

disengage in patent activity prior to, and scale up patent activity just after,

the passage of the act, in anticipation of the benefit that would be conferred

upon them once the act had passed into law. As the patent protection duration

expanded in the mid-1990s, the growth of patent activity at most universities

in the analytical sample increased marginally, indicating another firm response

to the patent law regime changes. Finally, preliminary results and the figures

in the Appendix indicate that the anticipation of the America Invents Act may

have had the largest impact in the rate of patent activity to date, evidence of

a university patent activity response to protect current research against a

more liberalized granting process.

These responses, evincing a move toward patent aggregation

by universities, may have lasting impact not only on the patent marketplace but

also on innovation. Yet, patent aggregation, in and of itself, is not

necessarily problematic. However, the symptoms of patent aggregation, such as

patent hold-up and rent-seeking licensing behaviors, are detrimental to the

promotion of innovation. Moreover, competition for federal funds that leads to

the production of patentable technology of little economic value could evince

another market inefficiency to which universities may substantially contribute.

This study—the first in a series investigating how

universities make decisions about their intellectual property, and whether

these decisions redound to the public good—demonstrates that research

universities, doctoral granting institutions, and specialized institutions

respond strategically to patent policy changes in ways that carry profound

consequences for innovation and the public good. It is clear that changes to

patent policy are necessary to incentivize universities to reap the benefits of

research and development of patentable technologies while promoting innovation.

* * *

Appendix

Patent and Trademark Law Amendments (Bayh-Dole) Act, Pub. L. No. 96-517, 94

Stat. 3015, 3019 (1980).

See Uruguay Round Agreements Act, Pub. L. No. 103–465,

108 Stat.

4809, 4984 (1994)

(codified at 35 U.S.C. § 154(a)(2) (1994)).

See generally Stuart W. Leslie, The Cold War and American Science: The

Military-Industrial Academic Complex at MIT and Stanford (1993); Christopher P. Loss, Between Citizens and the

State: The Politics of American Higher Education in the 20th Century

224-25 (2012).

See generally David Mowery, et Al., Ivory Tower and Industrial Innovation:

University-industry Technology Transfer before and after the Bayh-Dole Act

(2015) (noting the trend of universities to transfer patent rights to patent

assertion entities in recent years); Donald S. Siegel, David Waldman &

Albert Link, Assessing the Impact of

Organizational Practices on the Relative Productivity of University Technology

Transfer Offices: An Exploratory Study, 32 Research Pol’y

27 (2003) (analyzing productivity in university technology transfer offices and

finding that many are only successful at litigating infringement, not bringing

the technology to market); Matkin, Technology Transfer and the University

(1990) (exploring university patent transfer after the Bayh-Dole Act).

For instance, the Supreme Court recently limited the scope of patent venue in

its unanimous decision in TC Heartland v.

Kraft Foods, which was motivated by flagrant “forum selling” in the

district courts. TC

Heartland vs. Kraft Foods Group Brands, 137 S. Ct. 1514 (2017). For the Federal

Circuit’s decision, which was reversed by the Supreme Court, see TC Heartland vs. Kraft Foods Group

Brands, 821 F.3d 1338 (Fed. Cir. 2016). Forum selling is an issue many scholars

have identified as increasing the costs to innovation. See, e.g., Brian L. Frye & Christopher J. Ryan Jr., Fixing Forum Selling, 25 U. Miami Bus. L. Rev. 1 (2017); Gregory

Reilly & D. Klerman, Forum Selling, 89 S. Cal L.

Rev. 241 (2016); Chester S. Chuang, Offensive

Venue: The Curious Use of Declaratory Judgment to Forum Shop in Patent

Litigation, 80 Geo. Wash. L. Rev. 1065

(2011); Elizabeth P. Offen-Brown, Forum Shopping and Venue Transfer in Patent

Cases: Marshall’s Response to TS Tech

and Genentech, 25 Berkeley Tech. L.J.

61 (2010); Yan Leychkis, Of Fire Ants and Claim Construction:

An Empirical Study of the Meteoric Rise of the Eastern District of Texas as a

Preeminent Forum for Patent Litigation, 9 Yale

J.L. & Tech. 194 (2007).

[7] See, e.g., Mark Lemley, Where to File

Your Patent Case 4-27 (Stanford Public Law, Working Paper No. 1597919,

2010), http://law.stanford.edu/wp-content/uploads/sites/default/files/publication/260028/doc/slspublic/ssrn-id1597919.pdf; Li Zhu, Taking Off: Recent Changes to Venue Transfer

of Patent Litigation in the Rocket Docket, 11 Minn. J.L. Sci. & Tech. 901 (2010); Alisha Kay Taylor, What Does Forum Shopping in the Eastern

District of Texas Mean for Patent Reform, 6 Intell. Prop. L. 1 (2006).

See, e.g., Sara Jeruss,

Robin Feldman & Joshua Walker, The

America Invents Act 500: Effects of Patent Monetization Entities on US

Litigation, 11 Duke L. & Tech.

Rev. 357 (2012); Tracie L. Bryant, The

America Invents Act: Slaying Trolls, Limiting Joinder, 25 Harv. J.L. & Tech. 697 (2011).

U.S. Const. art. I, § 8, cl. 8. See also,

A Brief History of Patent Law of the

United States, Ladas & Parry,

http://ladas.com/a-brief-history-of-the-patent-law-of-the-united-states-2/

(May 7, 2014). In this article, the term “patent” is used to refer exclusively

to utility patents. While the United States Patent and Trademark Office also

issues design patents and plant patents, and the United States Code provides

for protection of vessel hull designs and mask works, both of which resemble

design patents, all of these forms of intellectual property are outside the

scope of this article.

See, e.g., James Bessen & Michael J. Meurer, Patent Failure (2008) (questioning the

efficiency of the patent system); William W. Fisher, The Growth of Intellectual Property: A History of the Ownership of

Ideas in the United States, in Eigentum im internationalen Vergleich

255-91 (1999) (decrying the antitrust implications of intellectual property

protection at the exclusion of innovation); Dan L. Burk & Mark A. Lemley, Is Patent Law

Technology-Specific?, 17 Berkeley

Tech. L.J. 1155 (2002) (observing that the patent system seems to

provide efficient incentives in some industries, but not others); but see, e.g., Robert P. Merges, Justifying Intellectual Property (2011)

(concluding that the patent system is broadly justified).

Research Corporation was formed in 1912 by Professor Frederick Cottrell of the

University of California to manage his own inventions, as well as those others

submitted by faculty members of other educational institutions. See Frederick Cottrell, The Research Corporation, an Experiment in

Public Administration of Patent Rights, 4 JIndust. & Engineering Chemistry 846

(1912).

[15] By 1952, 73 universities had

adopted a formal patent policy. By 1962, 147 of 359 universities that conducted

scientific or technological research had adopted a formal patent policy, but

596 universities reported that they conducted “little or no scientific or

technological research” and had no formal patent policy. American Association

of University Professors, American

University Patent Policies: A Brief History, https://www.aaup.org/sites/default/files/

files/ShortHistory.pdf (last visited Oct. 23, 2017).

This increase in patent activity at universities between 1968 and 1980 is

almost certainly a response to the Institutional Patent Agreement. See Rooksby, supra note 11,

at 130-35; American Association of University Professors, supra note 15.

Patent and Trademark Law Amendments (Bayh-Dole) Act, Pub. L. 96-517, 94 Stat.

3015, 3019 (1980).

35 U.S.C. § 202(c)(7) (2011).

See Mark A. Lemley,

Are Universities Patent Trolls?, 18 Fordham Intell. Prop.

Media & Ent. L.J. 611 (2008). But

see Jonathan Barnett, Has the Academy

Led Patent Law Astray? Berkeley Tech.

L.J. (forthcoming 2017), https://ssrn.com/abstract=2897728.

See Diamond v. Chakrabarty,

447 U.S. 303 (1980) (holding that patentable subject matter included

genetically modified organisms); Diamond v. Diehr,

450 U.S. 175 (1981) (holding that patentable subject matter included certain

kinds of computer software); Patent and Trademark Law Amendments Act, Pub. L.

No. 96-517, 94 Stat. 3015 (1980) (amending 35 U.S.C. § 301 and allowing

universities to take title in the patentable results of funded research).

See Federal Courts Improvement Act,

Pub. L. No. 97-164, 96 Stat. 25 (1982) (creating an appellate-level court, the

U.S. Court of Appeals for the Federal Circuit, with the jurisdiction to hear

patent cases).

See Drug Price Competition and Patent

Term Restoration Act, Pub. L. No. 98-417, 98 Stat. 1585 (1984) (enabling

generic pharmaceutical companies to develop bioequivalents

to patented innovator drugs).

See Uruguay Round Agreements Act,

Pub. L. No. 103–465, 108 Stat.

4809, 4984 (1994)

(codified at 35 U.S.C. § 154(a)(2)).

See United

States Patent and Trademark Office Patent Technology Monitoring Team, U.S.

Patent Statistics Chart, Calendar Years 1963 – 2015 (2016), https://www.uspto.gov/web/offices/ac/ido/oeip/taf/us_stat.htm.

Id.

Id.

[29] Id.

Association of University Technology

Managers (AUTM) STATT Database, www.autm.net/resources-surveys/research-reports-databases/statt-database-%281%29/.

See Rooksby, supra note 11,

at 139-50. See also Joseph Friedman

& Jonathan Silberman, University

Technology Transfer: Do Incentives, Management, and Location Matter?, 28 J. Tech. Transfer 17 (2003); Mowery,

et. Al., supra note 5,

at 24-40.

See Francis M. Bator, The Anatomy of Market Failure, 72 Q. J. Econ. 351, 377 (1958).

See, e.g., Kenneth J. Arrow, Economic Welfare and the Allocation of

Resources for Invention, in Readings

in Industrial Economics, 219-36 (1972); Francis M. Bator, The Anatomy of Market Failure, 72 Q. J. Econ. 351 (1958); Charles M. Tiebout, A Pure

Theory of Local Expenditures, 64 J.

Political Econ. 416 (1956).

Because the benefits of patent protection disincentivize

the inventor form further innovating the patented invention, patent law can be

said to discourage innovation. This is because—from the time the invention is

granted a patent—the inventor’s costs are sunk, meaning that the inventor must

incur new development costs and secure a new patent in order to innovate under

the patent law regime. See id. at

38-39.

See generally Colleen V. Chien, From Arms Race

to Marketplace: The Complex Patent Ecosystem and Its Implications for the

Patent System, 62 Hastings L. J.

297 (2010).

Id. See also Thomas L. Ewing, Indirect Exploitation of Intellectual

Property Rights by Corporations and Investors, 4 Hastings Sci. & Tech. L. J. 1 (2011); but see David L. Schwartz & Jay P. Kesan, Analyzing the

Role of Non-Practicing Entities in the Patent System, 99 Cornell L. Rev. 425 (2014) (arguing that

the debate over non-practicing entities should be reframed to focus on the

merits of the lawsuits they generate, including patent system changes focusing

on reducing transaction costs in patent litigation, instead of focusing solely

on whether the patent holder is a non-practicing entity); Holly Forsberg, Diminishing the Attractiveness of Trolling:

The Impacts of Recent Judicial Activity on Non-Practicing Entities, 12 Pitt. J. Tech. L. & Pol’y

1 (2011) (centering on the difficulties faced by legislators in attempting to

solve the patent troll problem and turns to the recent judicial activity

related to patent law allowing for individually-focused, closely tailored

analysis is examined with an evaluation of four recent court decisions and

resulting changes to the patent system).

See Daniel A. Crane, Intellectual Liability, 88 Tex.

L. Rev. 253 (2009). See also

James Boyle, Open Source Innovation,

Patent Injunctions and the Public Interest, 11 Duke L. & Tech. Rev.

30 (2012) (noting that open source innovation is unusually vulnerable to patent

injunctions); John R. Allison, Mark A. Lemley &

Joshua Walker, Extreme Value or Trolls on

Top? The Characteristics of the Most-Litigated Patents, 158 U. Penn. L. Rev.

1 (2009); John R. Allison, Mark A. Lemley &

Joshua Walker, Patent Quality Settlement

Among Repeat Patent Litigants, 99

Georgetown L. J. 677 (2011);

Colleen V. Chien & Mark A. Lemley,

Patent Holdup, the ITC, and the Public

Interest, 98 Cornell L. Rev. 1 (2012).

See Chien

& Lemley, supra note 40

(noting the unintended consequence of the Supreme Court’s ruling in eBay v. MercExchange, 547

U.S. 388 (2006), namely, the driving patent forces entities to a different

forum, the International Trade Commission (ITC), to secure injunctive relief

not available in the federal courts); Thomas F. Cotter, Patent Holdup, Patent Remedies, and Antitrust Responses, 98 J. Corp.

L. 1151 (2009).

[42] See Ronald Coase, The Problem of Social Cost, 3 J.

L. & Econ. 1 (1960).

See Brownwyn

H. Hall, Exploring the Patent Explosion,

30 J. Tech. Transfer 35 (2005); U.S. Patent and Technology Office, U.S. College

and University Utility Patent Grants – Calendar Years 1969 – 2012, https://www.uspto.gov/web/offices/ac/

ido/oeip/taf/univ/univ_toc.htm (last

visited Oct. 23, 2017) (examining the sources of patent growth in the United

States since 1985, and confirming that growth has taken place in all

technologies); Rosa Grimaldi, Martin Kenney, Donald

S. Siegel & Mike Wright, 30 Years

after Bayh-Dole Act: Reassessing Academic Entrepreneurship, 40 Res. Pol’y 1045

(2011) (discussing and appraising the effects of the legislative reform

relating to academic entrepreneurship); Elizabeth Popp Berman, Why Did Universities Start Patenting?

Institution-Building and the Road to the Bayh-Dole Act, 38 Soc. Studies of Sci. 835 (2008); Leslie, supra note 4;

Loss, supra note 4,

at 224-25. But see Elizabeth Popp

Berman, , 38 Soc. Studies of Sci. 835 (2008) (noting

that while observers have traditionally attributed university patenting to the

to the Bayh-Dole Act of 1980, university patenting was increasing throughout

the 1970s, and explaining the rise of university patenting as a process of

institution-building, beginning in the 1960s).

David C. Mowery, Richard R. Nelson, Bhaven N. Sampat & Arvids A. Ziedonis, The Growth

of Patenting and Licensing by US Universities: An Assessment of the Effects of

the Bayh-Dole Act of 1980, 30 Pol’y 99 (2001) (examining the effect of the

Bayh-Dole Act on patenting and licensing at three universities—Columbia,

Stanford, and California-Berkeley—and suggesting that the Bayh-Dole Act was

only one of several important factors behind the rise of university patenting

and licensing activity); see also

Harold W. Bremer, The First Two Decades of the Bayh-Dole Act, Presentation to the National

Association of State Universities and Land Grant Colleges (Nov. 11, 2001)

(attributing the proliferation of technology transfer to the Bayh-Dole Act).

See, e.g., Jennifer Carter-Johnson, Unveiling the Distinction between the

University and Its Academic Researchers: Lessons for Patent Infringement and

University Technology Transfer, 12 Vanderbilt

J. Entertainment & Tech. L. 473 (2010) (exploring the idea that a

faculty member acting in the role of an academic researcher in the scientific

disciplines should be viewed in the context of patent law as an autonomous

entity within the university rather than as an agent of the university, and

arguing that acknowledging a distinction between the university and its

academic researchers would revive the application of the experimental use

exception as a defense to patent infringement for the scientists who drive the

innovation economy and encourage academic researchers to participate in

transferring new inventions to the private sector); Martin Kenney & Donald

Patton, Reconsidering the Bayh-Dole Act

and the Current University Invention Ownership Model, 38 Res. Pol’y 1407 (2009)

(citing the problems with the Bayh-Dole Act’s assignment of intellectual

property interests, and suggesting two alternative invention commercialization

models: (1) vesting ownership with the inventor, who could choose the

commercialization path for the invention, and provide the university an

ownership stake in any returns to the invention; and (2) making all inventions

immediately publicly available through a public domain strategy or, through a

requirement that all inventions be licensed non-exclusively); Liza Vertinsky, Universities

as Guardians of Their Inventions, 4 Utah

L. Rev. 1949 (2012) (submitting that universities need more “discretion,

responsibility, and accountability over the post-discovery development paths

for their inventions,” in order to allow the public benefit of the invention to

reach society, and arguing that, because universities guard their inventions,

the law should be designed to encourage their responsible involvement in

shaping the post-discovery future of their inventions).

35 U.S.C. §154 (1994); 125 Stat. §§ 284-341 (2011).

See Kira R. Fabrizio,

Opening the Dam or Building Channels: University Patenting and the Use of

Public Science in Industrial Innovation (Jan. 30 2006) (working paper) (on file with the Goizueta

School of Business at Emory University) (investigating the relationship between

the change in university patenting and changes in firm citation of public

science, as well as changes in the pace of knowledge exploitation by firms,

measured using changes in the distribution of backward citation lags in

industrial patents); Hall, supra note 43

(confirming that growth since 1984 has taken place in all technologies, but not

in all industries, being concentrated in the electrical, electronics,

computing, and scientific instruments industries); Michael D. Frakes & Melissa F. Wasserman, Does Agency Funding Affect Decisionmaking?:

An Empirical Assessment of the PTO’s Granting Patterns, 66 Vanderbilt L. Rev.

67 (2013) (finding that the PTO is preferentially granting patents on

technologies with high renewal rates and patents filed by large entities, as

the PTO stands to earn the most revenue by granting additional patents of these

types); Tom Coupé, Science Is Golden:

Academic R&D and University Patents, 28 J.

Tech. Trans. 31 (2003) (finds that more money spent on academic research

leads to more university patents, with elasticities that are similar to those

found for commercial firms).

See Clovia

Hamilton, University Technology Transfer

and Economic Development: Proposed Cooperative Economic Development Agreements

Under the Bayh-Dole Act, 36 J.

Marshall L. Rev. 397 (2003) (proposing that Congress amend the Bayh-Dole

Act to provide guidance on how universities can enter into Cooperative Economic

Development Agreements patterned after the Stevenson-Wydler

Act’s Cooperative Research and Development Agreements); Lita

Nelsen, The Rise of Intellectual Property

Protection in the American University, 279 Science

1460, 1460-1461 (1998) (describing the inputs and outcomes of university

assertion of intellectual property rights); Nicola Baldini,

Negative Effects of University Patenting:

Myths and Grounded Evidence, 75 Scientometrics

289 (2008) (discussing how the university patenting threatens scientific

progress due to increasing disclosure restrictions, changes in the nature of

the research (declining patents’ and publications’ quality, skewing research

agendas toward commercial priorities, and crowding-out between patents and

publications), and diversion of energies from teaching activity and reducing

its quality); Lemley, supra note 7

(illustrating that universities are non-practicing entities, sharing some

characteristics with trolls but somewhat distinct from trolls, and making the

normative argument that the focus should be on the bad acts of all

non-practicing entities and the laws that make these acts possible); Jacob H. Rooksby, University

Initiation of Patent Infringement Litigation, 10 John Marshall Rev. Intell. Prop. L. 623

(2011) (revealing similarities between the litigation behavior of universities

and for-profit actors, as well as complex and varied relationships between

universities, their licensees, and research foundations closely affiliated with

universities).

See generally Mowery, et al., supra note 5;

Christopher A. Cotropia, Jay P. Kesan

& David L. Schwartz, Unpacking Patent

Assertion Entities (PAEs), 99 Minn.

L. Rev. 649 (2014); Sara Jeruss, Robin Feldman

& Joshua Walker, The America Invents

Act 500: Effects of Patent Monetization Entities on US Litigation, 11 Duke L. & Tech. Rev. 357 (2013).

See Cyert & James G. March, A Behavioral Theory of

the Firm (Herbert A. Simon ed., Prentice-Hall Inc. 1963).

See Lattuca & Joan S. Stark, Shaping

the College Curriculum: Academic Plans in Context 24 (2d ed. 2009) (modeling visually the interaction

between universities and external influences such as governments).

(2002), http://citeseerx.ist.psu.edu/viewdoc/download?

doi=10.1.1.453.1958&rep=rep1&type=pdf (noting

that such a duty transforms the academia-industry relationship from the

traditional view of disparate entities into a Congressionally-mandated

partnership, intended to advance technology and benefit the public).

See Valerie L. McDevitt et al., More than Money: The Exponential Impact of Academic Technology Transfer,

16 Technology & Innovation 75 (2014).

Id.

This study employs data from the Carnegie Classification of Institutions of

Higher Education, U.S. College and

University Utility Patent Grants – Calendar Years 1973, 1987, 1994,

2000, 2005, 2010, with years 1994, 2000, 2005, and 2010, http://carnegieclassifications.iu.edu/downloads.php

(last accessed Oct. 23, 2017). However, because the Carnegie Commission on

Higher Education changed its classification standards in 2010, the “basic”

classification standard was used to impute these values for each classification

observation from 2010 to 2012.

The “basic” Carnegie Classifications split Doctoral-Granting institutions into

four subgroups: Research Universities I and II, and Doctoral-Granting

Universities I and II. Research universities originally were considered the

leading universities in terms of federal financial support of academic

research, provided they awarded a minimum threshold of Ph.D.’s and/or M.D.’s.

Doctoral-granting universities were originally conceived of as smaller

operations, in terms of federal funding and doctoral production, but comparable

in scope to the research universities. Next, the Comprehensive Universities I

and II met minimum enrollment thresholds, offered diverse baccalaureate

programs and master’s programs, but lacked substantial doctoral study and

federal support for academic research. The Liberal Arts Colleges I and II were

selected somewhat subjectively in the first several iterations of the Carnegie

Classifications; this is particularly the case for Liberal Arts Colleges II,

which did not meet criteria for inclusion in the first liberal arts college

category but were not selected for Comprehensive University II, either. The

Liberal Arts Colleges I included colleges with the most selective baccalaureate

focused liberal arts programs. As for the specialized institutions, which are

divided into nine categories, the medical, health and engineering schools

tended to be stand-alone institutions or institutions affiliated with a parent

higher education institution but maintaining a separate campus. Last, the

“other specialized institutions” included in the analytical sample are drawn from

schools of art, music, and design, as well as graduate centers, maritime

academies, and military institutes. Id.

As an illustrative example of collapsing an administrative unit on the parent

institution, Washington University School of Medicine was collapsed on

Washington University. This also applied to foundations and boards of regents,

which were collapsed on the flagship institution, given that the vast majority

of observations in this dataset are standalone or flagship institutions; for

example, the University of Colorado Board of Regents and the University of

Colorado Foundation are collapsed on the University of Colorado, given that no

other institution from the University of Colorado system appears in the PTO

dataset. Finally, independent institutions within the same university system

were treated as different observations: the University

of Texas Southwestern Medical Center is distinctly observed from the University

of Texas at Austin or even the University of Texas at Dallas, the city in which

the University of Texas Southwestern Medical Center is located.

Stata FAQ: How Can I Run a Piecewise

Regression in Stata?, Univ. of Calif.

Los Angeles Inst. for Digital Research and Educ. (2016), https://stats.idre.ucla.edu/stata/faq/

how-can-i-run-a-piecewise-regression-in-stata/. Effectively, calculating the slope and

intercept shifts by hand using spline regression rescales the variable “year”

by centering it on the location of the spline knot. For example, the first

spline knot (k1) is

centered on 1981, with all years before it counting up to zero and all years

after—but before the next spline knot—counting up

from zero. Including the centered “year” variable in the regression equation

also requires adding an indicator variable of the intercept before and after

the spline knot. Because the model has an implied constant—the intercepts

before and after the spline knot should add up to 1—the overall test of the

model will be appropriately calculated by hand. To finish estimating the slope

and intercept differences by hand, this regression approach requires the use of

the “hascons” option, because of the implied

intercept constant. Alternatively, the “mkspline”

package in Stata 13 can be used to conduct this estimation. Both approaches

were used and yielded substantially similar results. The estimates from using

the “mkspline” command are

reported below for ease of interpretation.

James H. Steiger, An

Introduction to Splines, StatPower

(2013), http://www.statpower.net/Content/313/Lecture%20Notes/Splines.pdf.

35 U.S.C. § 301 (2006) (permitting universities to take title in inventions and

discoveries produced through federally-funded research); 35 U.S.C. § 154(a)(2)

(2006) (extending the duration of patent protection from seventeen to twenty

years); 35 U.S.C. § 100(i) (2006) (changing the right

to the grant of patent from first-to-invent to first-inventor-to-file).