Andrew P. Morriss* & Roger E. Meiners**

Download a PDF version of this article here.

In The Nature of the Firm, Ronald Coase explains how firms represent a suspension of the market mechanism. The allocation of activities depends on the relative costs of organizing activities within the firm versus direct reliance on the market. Despite Coase’s insight, economists often treat firms as black boxes with respect to innovation. Firms take in resources and produce innovations but why firms are successful at innovation is unspecified. As a result, the factors that enable wealth creation within the black boxes of firms, a key factor in economic progress, are little understood. Firms are not the only source of innovation, however. Economically valuable research also emerges from non-profit universities. They represent an alternative (which we term the “red box”) to research that occurs within firms’ black boxes, an alternative with specific advantages and disadvantages in producing innovations. Using a comprehensive set of patent data, we show that university patenting is largely the result of activity by a tiny subset of U.S. universities, contrary to the Bayh-Dole Act’s promise that it would produce a massive technology transfer from universities to the marketplace.

In this Article, we argue that research in non-profit universities is distinct from research in a for-profit firm. As a result, the process of moving inventions from the university to the market usually occurs through licensing innovations to firms that have a comparative advantage in assessing possible market value of inventions and can risk capital to exploit innovations. Because successful commercialization of the product of research requires entrepreneurship, we use the insights into entrepreneurship of economists Joseph Schumpeter and Israel Kirzner to begin to unpack the red box of university commercialization efforts. This Article examines the practices that have emerged after the Bayh-Dole Act’s grant of intellectual property rights to universities for the results of federally funded research and the many constraints imposed by university structure. It also considers how the differences in the incentive structure with black and red boxes create a role of university research.

Introduction

Research universities funded by governments, non-profits, for-profits, and internal resources generate ideas.1 Some ideas are purely intellectual exercises: interpretations of Shakespeare, understandings of archeological findings, explanations of data on distant stars, or analyses of long-dead philosophers. But considerable resources go to research that has the potential for commercial payoffs: new drugs and medical devices, new seed varieties, improved industrial processes, and new materials. At one time, successful products were largely serendipitous. But since the Bayh-Dole Act gave universities the intellectual property rights to the fruits of federally funded research in 1980, the effort to commercialize research has become both more formalized and more important. Sponsors often want research with potential for commercialization through license agreements or start-ups: “Technology that remains in the lab provides almost no economic benefits.”2 Broader goals include revenue for universities, economic impact for states and communities, and prestige.3 To get technology out of labs and into the economy, the federal government granted universities intellectual property rights to the federally-funded research conducted by researchers via the Bayh-Dole Act of 1980.4 This model is spreading internationally as well.5

Federal research money has poured into universities since 1980. At the time Bayh-Dole was enacted, the funds up for competition via the National Science Foundation (NSF) and the National Institutes for Health (NIH) were paltry compared to what is at stake now. In fiscal 1980, the NSF was allocated $904 million. In 2021, the allocation was $6,910 billion.6 Nine schools received more than $100 million in grant money.7 Adjusting for inflation, this is more than a doubling in real terms of the funds available. The total NIH budget in 1980 was only $3.4 billion.8 In 2021, its budget was $42.7 billion, more than a fourfold increase in real terms.10 Researchers and administrators in non-profit universities aggressively seek more research funding.11

Unfortunately, Bayh-Dole was based on an overly simplistic linear model of innovation in which money poured in at the start of an invention pipeline in funding to produce useful commercial innovations at the other end. In some respects, the statute’s reliance on a simplistic model is unsurprising – the notion is old.12 Turning research results into products is not as simple as the linear model makes it out to be; Bayh-Dole took little notice of universities’ capabilities. As a result, despite pouring enormous amounts of funding into the innovation pipeline, we still struggle to get relevant research out of the laboratory and into the economy.13

Bayh-Dole’s results have been mixed. In 1980, at the end of the era when patents based on federally funded research were the property of the agency funding the research, universities were awarded 390 patents. Thirty years after universities acquired the patent rights to the results of federally-funded research, they were awarded more than 3,000 patents.14 By 2018, a survey found that universities had filed over 17,000 patent applications and received over 7,000 patents in that year alone and held a total of 77,880 patents.15 But patents have often translated into products. A 2010 study by the Association of University Technology Managers (AUTM) identified 657 products that resulted from university research and development, over 5,000 licenses for technologies, and 650 new companies.16 Even if it did not produce a flood of products, Bayh-Dole led to more research about commercialization: a survey found 173 articles published on the topic of commercializing university-based research between 1981 and 2005, three-quarters of them appearing between 2000 and 2005.17 This growth is the source of many of the claims that universities serve as engines of economic development. Unfortunately, only a handful of universities excel at commercialization, including Columbia, Stanford, and the Massachusetts Institute of Technology.18 “Many universities (in fact, most) do not have the economic capability, manpower, access to venture capital, nor desire to tend to an invention all the way from discovery to commercialization.”19 We argue that the neglect of entrepreneurship by universities is one reason for this lack of success. Despite frequent claims to be entrepreneurial in exploiting research, the survey of 173 articles noted above found few references to actual entrepreneurship among universities.20

Success in patenting (a commonly used measure of university research success) varies considerably and just a small number of universities do the vast majority of it. To measure universities’ patent performance, we used the PatentVector™ database. PatentVector™ contains the universe of digitized patent documents (both patents and patent applications) for the entire world.21 An eigenvector centrality algorithm (the same family as Google’s PageRank™ algorithm) provides a score for each patent.22 The score correlates well with extrinsic measures of value and is scaled to make the average patent have a score of 1.0. That is, a patent with a score of 2.0 is twice as central as a patent with a score of 1.0. We included both current and expired patents as we were interested in universities’ total performance across time, not just their current portfolios.

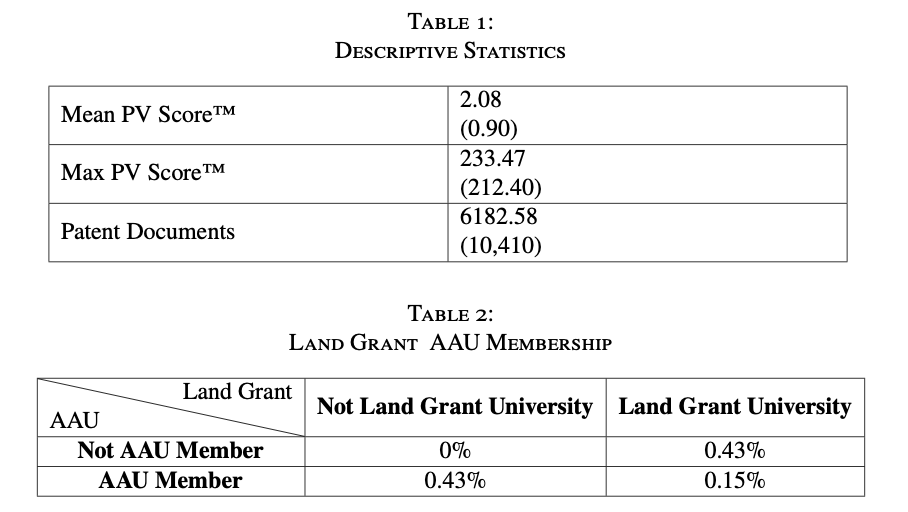

There are roughly 4,000 U.S. colleges and universities. Patenting and research activities are far from equally distributed among them. In our calculations, we include only members of the American Association of Universities (AAU), an organization of research universities with relatively stringent membership criteria, and land grant universities, which have a mission to develop and transfer technology to the public, in our data, to avoid having large numbers of observations with zero patents.23 (There is overlap among the two categories: fourteen AAU members are also land-grant universities, while forty-one are not). We dropped ten universities on the initial list that had zero patents24 as well as ten that had ten or fewer patents.25 This left us with ninety-six universities, less than two percent of all four-year U.S. higher education establishments. We searched a comprehensive database, PatentVector™, for each university’s patent documents.26 Table 1 provides summary statistics for our three measures; Table 2 shows the distribution of schools among the AAU and land grant categories. We also considered the public/private status of the universities (32\% are private).

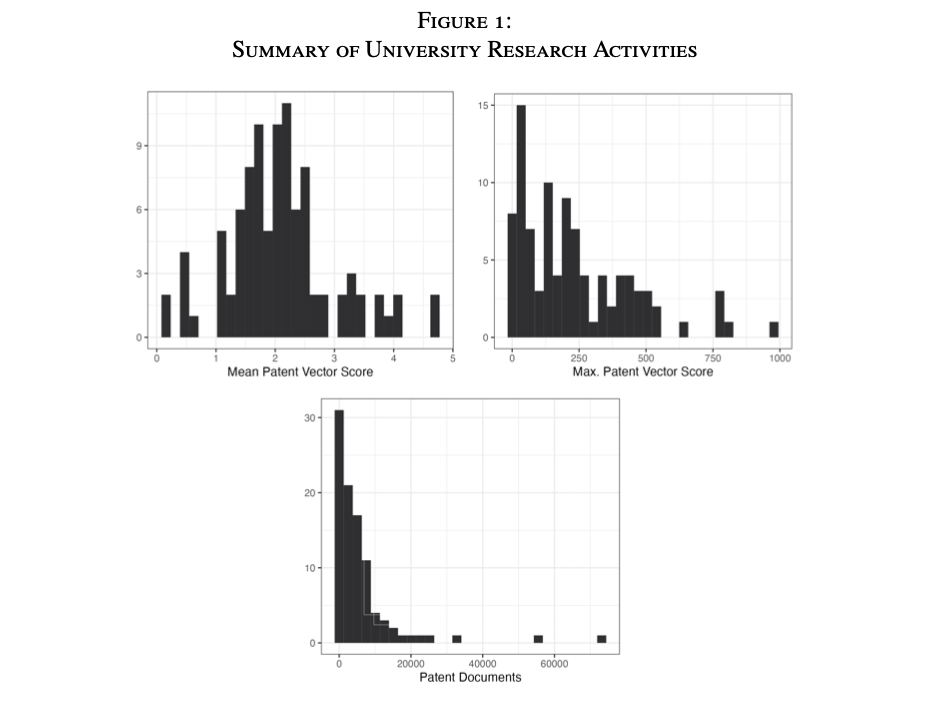

Universities perform differently by all three of these measures in Figure 1, which provides histograms for the complete set.

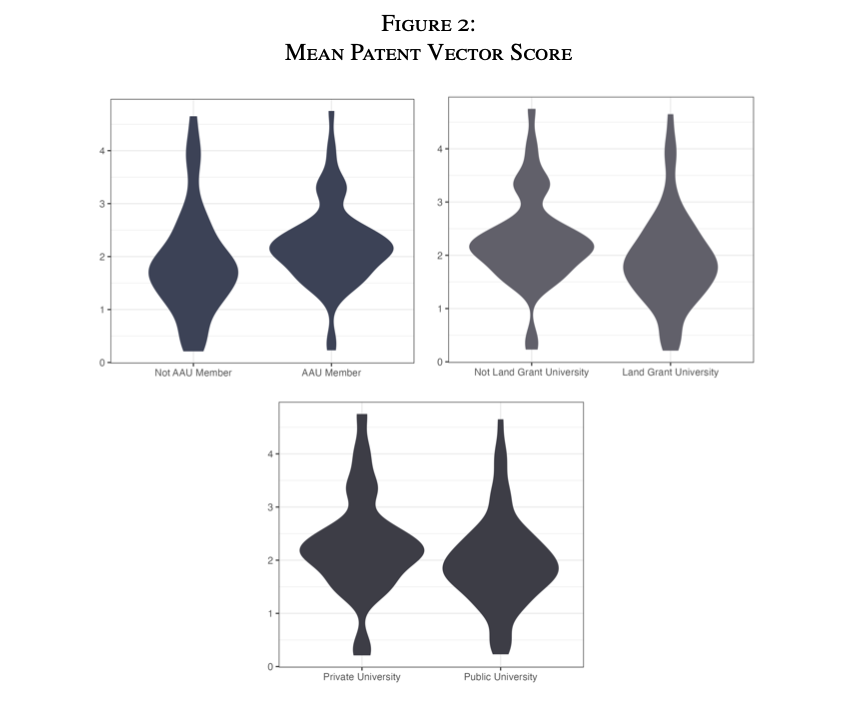

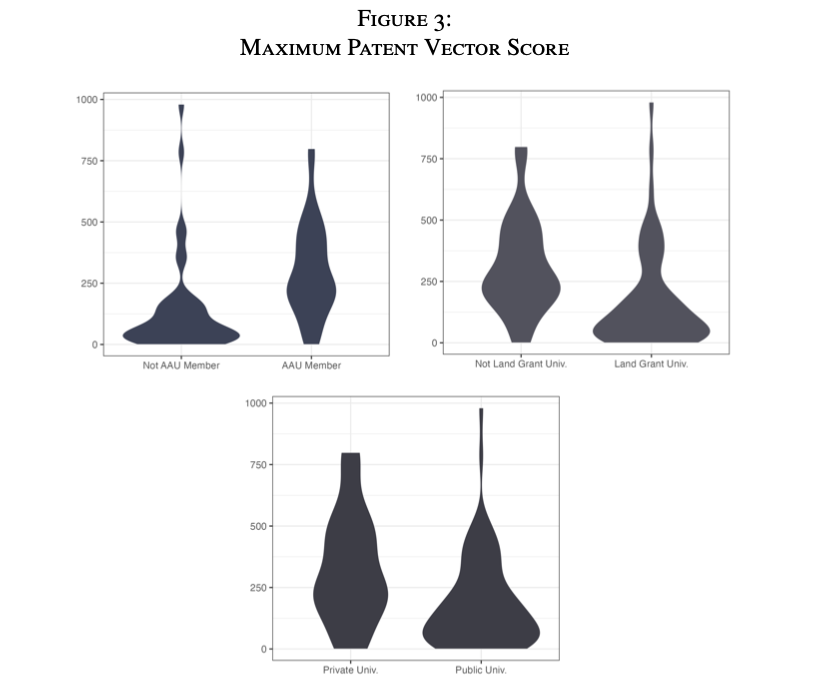

We see this pattern in Figures 2, 3, and 4 as well, which provide “violin” plots of the data, disaggregated by public, AAU, and land grant statuses. Two conclusions can be drawn from these diagrams and statistics. First, there are substantial differences in the amount of patenting and, more importantly, the amount of patenting of valuable ideas, among universities. Indeed, for measuring the importance of ideas, PatentVector™’s eigenvector-based score is an excellent measure, even better than dollar values, since it represents the centrality of a patent within the network of patented ideas.27 Just a few universities produce the vast majority of patent documents in our sample: eleven produce half, and twenty-two produce two-thirds.28 The bottom fifty produce just ten percent of the patent documents.

Examining the patent documents by mean PVScore™ shows that even some small players are successful. Princeton, which is only 35th in total patent documents, tops the list for mean scores at 4.75, followed closely by New Mexico State University, which has only 101 patent documents but an impressive mean of 4.65. Indeed, just MIT and Stanford are in both the top 11 by mean PVScore™ and by number of patent documents. These differences are unsurprising. Even if the University of California System has more high value patents in absolute terms in its more than 73,000 patent documents, it will also have many average or low value ones as well than there will be among Princeton’s just over 5,000 or New Mexico State’s 101. In calculating the average PVScore™, the thousands of average value ones will dominate the average. In general, the larger bulge higher up for AAU members suggests that those universities are more successful at generating valuable patents. (In future work, we plan to delve more deeply into these statistics and generate additional measures of success.)

Why haven’t the billions of dollars in federal research money led to a broad-based, technology-driven economic boom based on university research? Our argument is that an important reason is that Bayh-Dole, federal policy on innovation, generally, and many university efforts are not built around a realistic model of how innovations become commercial products. In particular, the role of entrepreneurship is neglected by both policymakers and universities. This is unsurprising as, even in the private sector, how firms successfully stimulate innovation is unclear. For the most part, firms are treated in this regard as black boxes, the mechanics of which are skipped over in economic analysis.29 Even less understood than the private sector is how university research can evolve into market-valued products.

To fill this gap, we turn to the ideas of the economists who studied entrepreneurship, most notably Joseph Schumpeter and Israel Kirzner. Oddly, they are generally ignored in the literature on commercialization of innovations.30 This Article is a step to bring their ideas more fully into the discussion of the conditions relevant to greater levels of valuable innovations that help spur economic progress. We focus on Schumpeter and Kirzner as applied to inventions that occur in what we term the “red box” of universities, which, because they are non-profit institutions, differ significantly from the “black boxes” of for-profit firms.31 In both instances, the institutional incentive structures are absent from the discussion of the generation of valuable innovations and their evolution into products that succeed in the market.

Developing new ideas and turning them into products and services is the core of the entrepreneurial function: Schumpeter identified the essential function of the entrepreneur as the “doing of new things or the doing of things that are already being done in a new way (innovation).”32 Finding ways to accomplish this in the context of the university environment requires considering issues raised by the economic theory of entrepreneurship.

Part I of this Article examines how the red box context affects invention. There we develop the analogy to the black box of for-profit firms and explore the differences in incentive structures. Part II describes how U.S. universities approach commercialization. Part III applies an economic perspective to the commercialization process from the perspective of non-profit universities, looking to Schumpeter’s and Kirzner’s work for guidance on how to understand the process. Part IV concludes with suggestions on how the process might be improved.

I. Invention & Universities

To understand how universities might do a better job at commercializing emerging ideas, we need to be clear about the distinctive features of the red box of the university research environment compared to the black box of the commercial research environment. Hence, we summarize the general state of economic knowledge about working inside firms. This is contrasted to constraints generally faced inside universities. Then we consider how universities treat inventions.

A. Black & Red Boxes

The internal workings of for-profit firms, key actors in market economies and economic progress, were not traditionally well understood by economists. Nobel laureate Oliver Williamson, who works on the issue, notes that economics should “move beyond the older view of the firm as a production function or black box. We need to open the box and examine the mechanisms inside to get a better understanding of what is going on and why.”33 He notes further that “Innovation poses special challenges,” some of which are addressed by focusing on transaction costs, but there is no “well-rounded explanation.”34 Williamson’s work is complemented by that of Oliver Hart, also a Nobel Prize recipient (with Bengt Holmstrom) for “contributions to contract theory.”35 Hart notes that “In modern microeconomics textbooks, the firm is still represented in purely technological terms as a production function or production set.”36 In short, in standard economic theory it is presumed that diligent managers run organizations on behalf of the owners who wish to maximize profits. These managers face perfect competition in completely developed markets.37 Such assumptions allow effective modeling of activity outside the firm, but do not help understand what goes on inside the not-well-understood black box. Williamson, Hart, and others have advanced our understanding of how firms solve incentive problems (winning two Nobel Prizes while doing so), but how firms innovate remains relatively under-theorized.

The economics of the firm begin with the recognition that because organizing and operating firms is costly, there needs to be an economic rationale for their existence.38 Nobel Laureate Ronald Coase explained in his 1937 article, The Nature of the Firm, that firms exist where the transaction costs of organizing and operating a firm are less than the transaction costs of operating in the market.39 While Coase’s observation was eventually recognized as brilliant, it failed to spur further development by economists about the internal workings of firms for several decades.40 As that work developed, it yielded some insights. For example, while firms exist to reduce transaction costs, the savings from their creation can be transitory as “bureaucratic costs build up.”41 In more recent years, a rich literature has arisen on the role of contracts as firms deal with each other.42

As a result of this work, we know that firms engage in complex processes that no one person can grasp. Parties are brought to work together to further the objectives of the firm. But why firms are designed internally the way they are, where great variation is observed, is not as well understood.43 With respect to research and innovation within a firm, managers must grant authority to those with superior technical knowledge.44 This poses challenges to the firm in constraining resources to focus on areas of greater profit potential, because managers rarely have the same grasp of the scientific issues as the researchers they employ. In the context of non-profits like universities, there are even greater challenges to understanding the impact of their organization on the incentives facing researchers and others.45

The puzzle we need to address is thus why universities play such a large role (at least in dollar terms) in research. In other words, does funding research in universities serve an important function, distinct from that of for-profit firms, in developing research that leads to commercial products. Significant public and private money are invested in research at universities; why? Are there reasons to believe red boxes have advantages under certain conditions over black boxes?

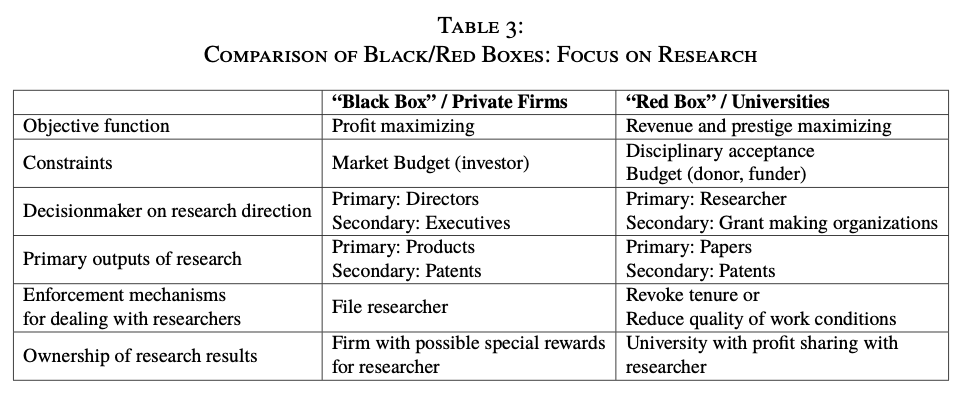

Table 3 summarizes some key differences in the internal incentive structures within black and red boxes. First, the two organizations have different objective functions. Firms focus on profit maximization and universities on maximizing revenue and prestige (recognized by things such as quality publications, prizes, and student placements). We should thus expect different behaviors from identical researchers depending on which environment the researcher works. We should also expect sorting between black and red box organizations in the characteristics of researchers who seek employment in each.

Second, the constraints in red and black boxes differ. While both face budget constraints, the constraints are quite different. Firms must attract investors (different kinds at different stages of development, but all motivated by the desire to profit); investors are interested in firms’ potential to grow net revenue. Investors often want to see results within a specific time frame.46 Universities must attract investments from donors and funding agencies, whose motives are not the same as for-profit investors. Universities generally do poorly at attracting investment in university-developed technologies because they do not operate on the same time scale as venture capitalists or other potential profit-minded investors.47 Firms also are subject to market constraints: they must produce goods people will buy. Universities, on the other hand, seek rewards from scientific (disciplinary) bodies that award prizes and grants, offers of lectureships and publication, etc. for successful faculty.

Third, the decision makers who determine research direction are different. In firms, the primary decision makers are the firm’s directors, who decide the overall direction. Secondary (day-to-day) decision makers are executives who allocate resources and approve research projects. In universities, the primary decision-makers are the researchers themselves, who are not assigned to projects but generate their own research agendas and funding. Hence, the research funders play a major role. Few major scientific research endeavors will proceed beyond the pilot stage in a university if they do not receive external funding. (The median NSF grant in FY 2021 to an engineering department was about $127,000).48 The researcher is the primary decision-maker because the researcher determines whether or not to initiate a project, even if its funding depends on outside sources. The NSF reports that principal investigators submit “about 2.3 proposals for every award they receive.”49

Fourth, researchers in firms produce ideas that may be patented as part of products offered in the market (possibly yielding revenue streams even if the firm where they are developed does not exploit them). University researchers may also produce research that yields patents, but this is generally less important than the production of scholarly papers. (Some critics of commercialization in universities allege that producing papers and patents are in conflict, although evidence suggests this is false.50)

Fifth, when a researcher is unproductive or does not follow guidance, a firm can fire them. Universities, on the other hand, have more trouble getting rid of unproductive researchers, particularly once they are tenured.

Lastly, firms and universities differ in ownership of research results. Firms generally own internal or contracted research results; researchers (especially productive ones) may receive a share of the rewards, but this is a matter for individual negotiations. Since Bayh-Dole, universities generally own the intellectual property rights (or have a right of first refusal to it) for research done on campus, but they usually share net profits with the researchers when results are commercially exploited.

The differences between university and corporate approaches are also illuminated by considering the small number of corporate laboratories widely recognized as successful at producing innovation: Bell Labs, IBM Research, and Xerox’s Palo Alto Research Center (PARC)51. All three bear a striking resemblance to universities in many of the dimensions described above.

These labs focused on getting smart researchers together and then letting them pursue their own agendas. AT&T created Bell Labs to access what its president termed in a 1958 speech a “special brand of brains.”52 Bell Labs freed them from worrying about AT&T’s actual businesses: “Researchers were thus free to select their own research topics without worrying about business relevance or management approval. They could even ignore management suggestions or stop working on a topic without the fear of serious negative repercussions, provided the research led to good results.”53 As one Bell Labs researcher put it, AT&T had determined that “freedom to pursue one’s own ideas and stable, long-term funding were the best well-springs of innovation.”54 Likewise, PARC’s managers believed “that the only way to get the best research was to hire the best researchers they could find and leave them unburdened by directives, instructions, or deadlines. For the most part, the computer engineers at PARC were exempt from corporate imperatives to improve Xerox’s existing products. They had a different charge: to lead the company into new and uncharted territory.”55 Similarly, “[f]rom 1945 up until the 1990s IBM Research was funded primarily by headquarters and by the hardware and software divisions. The scientists had their own research agenda with some occasional technology transfer, but this was not the norm.”56 Looking back on over a decade of work there in 1966, IBM’s European research director reflected that the company’s Swiss facility had proven to be “a breeding ground for ideas that lie outside the mainstream and that, accordingly, would find it difficult to be accepted in the large central organization,”57 hardly a description of an organization focused on developing commercial products!

Funding in these labs was unrelated to business purposes. While it was an effective monopoly (before the antitrust suit led to the company’s breakup),58 “AT&T was generous in funding Bell Labs [as were IBM and Xerox in funding their laboratories], but until the late 1980s, they did not seem to care what Bell Labs did or did not do as long as they excelled at science.”59 A similar change happened around the same time at IBM60 and at PARC, as Xerox’s financial position deteriorated.61

Many descriptions of these labs explicitly analogize to university environments. For example, Bell Labs is described as being “like a university that had no students, a zero teaching load, no tenure problems, no running around for grants, and plenty of money for equipment and travel. A researcher could focus on building his or her professional credentials and reputation. Within a few years, with Bell Labs on his or her resume, the researcher would have a passport to a tenured position at one of the top universities or would be able to walk into a senior research position at one of the industrial research labs.”62 One Bell researcher recalled that “we had all the benefits of academic freedom, along with good resources, and none of the teaching or administration loads that our counterparts in academia usually faced. Furthermore, compared to academia at that time, the pay was relatively good.”63 PARC’s university-like atmosphere was partly the result of most of its staff being recruited from universities.64 One of its researchers recalled, “A lot of us even came to feel we were sort of like university instructors who got to spend all our time doing research without having to teach classes.”65

Financial constraints were loose at these labs. A Bell researcher nostalgically recalled how he would let a computer run for entire weekends at a cost of $600 per hour, with the only consequence being that his budget was increased.66 Similarly, Hiltzik concludes in his history of PARC that a key factor in its success was “Xerox’s money, a seemingly limitless cascade of cash flowing from its near-monopoly on the office copier.”67

Once AT&T’s breakup forced the company to behave more competitively, it began to expect “Bell Labs to help it compete by developing technologies that would lead to new products and services.”68 When much of Bell Labs was spun off to Lucent, one of the successor businesses, a Lucent executive asked a researcher what he did that was of value to Lucent. The researcher could not answer, finally saying, “This is a new way of looking at long-term research for me.”69 Similarly, when IBM Research changed its motto from “famous for its science and technology and vital to IBM” to “vital to IBM’s future success,” half the physics research team left in response.70 Even internal IBM researchers note that the shift to focus on “actual customer problems” was “a completely unheard-of concept at the time.”71 Corporate demands for focus were not the only consequence of the breakup; fear of violating antitrust laws made researchers reluctant to collaborate.72 And when Xerox imposed a more corporate-minded manager on PARC, one of the changes he made was that 50\% of researchers’ evaluations would be based on how well they worked with the developing and manufacturing units of the company.73

The result of this freedom was considerable innovation.74 Bell Labs produced key breakthroughs in multiple areas, from lasers to semiconductors. PARC invented technologies still at the core of modern computer interfaces, from computer mice to graphical interfaces. IBM Research developed leading edge technologies in hardware and software, but also including the “Deep Blue” system that eventually bested Gary Kasparov at chess and the scanning tunneling microscope.75 While their corporate parents sometimes benefited from these innovations, the dominant strain in researchers’ recollections of their time at these institutions is that the company sponsors cared little about practical uses of what the researchers did.

It is striking that when companies could afford it and sought to “lead the company into new and uncharted territory”76 as Hiltzik described PARC’s mission or Bell Labs’ mission “to advance the nation’s telecommunications network,”77 they sought to replicate conditions much like those in universities. This suggests that there is something about the conditions within the red box that produce innovation which is unavailable in the black box.

The different incentive structures we find when we open the black and red boxes thus points to the importance of the different internal incentive structures and decision processes to at least some types of innovation. We should therefore expect that researchers will behave differently in different boxes and that the boxes should attract different types of researchers.78 The combination of the differences in behavior and the differences in structure likely make the research output of a red box different from the output of a black box. Buying research from a red box supplier rather than from a black box supplier may thus be an appropriate choice under some circumstances but not under others.

B. What Makes University Research Different?

University research differs from research at for-profit firms in important ways. First, academic and research faculty, staff, and students, who have significantly more discretion in their research programs than do most black-box researchers, produce most university-based research.79 Their discretion may include what they research and whether or not they seek intellectual property protection for the fruits of their research.80

Unlike employees in a corporate research laboratory, to gain a commercially viable invention, academic researchers must be persuaded to focus attention on problems of interest to the outside world and to conduct research to make it possible to commercialize or otherwise move it into the marketplace.81 Many rewards in universities are correlated with dissemination of ideas that are potentially inconsistent with commercialization. A common story among TTOs is one of getting phone calls from a researcher about to board a plane for a conference to give a presentation, the contents of which could disclose a potentially patentable idea. The researcher wants to know: “Can we get a patent before my talk tomorrow?”82 As publications and presentations are primary coins of the realm in academia, that this is a frequent enough experience to enter the broader lore is unsurprising. This also illustrates the difficulty TTOs face in balancing their need to seek intellectual property protections for ideas and faculty members’ needs to publish the results of work in a timely way.

Second, researchers in universities are sequestered, at least in part, from market pressures.83 University administrators worry about budgets, but most research faculty enjoy the freedom to not worry about those pressures84 and many likely sought positions in the academic world to avoid research dictated by market-driven employers. Indeed, significant freedom from market pressures is an important attribute of faculty culture.85 They may be able to choose whether to pursue commercialization of a particular research result or to release it into the public domain. A fundamental justification for university-based research is that it provides a public good (basic research) that firms under provide.86 To demonstrate their economic impact, both methods can provide universities with concrete examples of benefits to persuade federal and state legislatures to provide financial support.

Third, university hierarchies are structured differently from firms’.87 Coase described firms as alternatives to the market organization of transactions;88 universities are another form of such an organization. Coase quoted economist D. H. Robertson’s image of firms as “islands of conscious power in this ocean of unconscious cooperation like lumps of butter coagulating in a pail of buttermilk” to illustrate the differences between firms and the market.89 In Coase’s formulation, firms offer a command-and-control structure in place of a market. Transactions occur within firms when the net advantages of command-and-control are greater than those of the decentralized marketplace and the unconscious coordination of the price mechanism.90 We posit that universities fall between the solidity of the firms-as-lumps-of-butter and the fluidity of the marketplace-as-buttermilk. Universities’ collective governance means that they have ‘less conscious power’ than most firms but they are nonetheless more ‘solid’ than the marketplace and they lack the coordinating mechanism of an internal price mechanism.91 Organizing research within a university in pursuit of some goal is likely less clear than in a ‘more solid’ for-profit company. The looser constraints universities provide is a significant part of the reason why organization is more difficult but, as noted above, may also be a key to enabling a different type of research.

Moving a university toward commercialization is not an easy task. For example, Siegel, et al. found disagreements over whether start-ups should be encouraged at a particular university, where the vice president for research favored them, but a faculty member commented that “we need to stop pretending that academics can be entrepreneurs, or at least good ones.” This signaled a need for university officials “to devote more time and effort to ensuring such goals permeate their institutions.”92 115, 130 (2004).[/efn_note] Getting those goals to “permeate” university culture is not simply a matter of adopting them – faculty skeptical of the role of commercialization need to be persuaded to participate and/or to not oppose participation by other faculty. The great variety in university research enabled by decentralized research interests can be an organizational strength, as it allows relatively unconstrained pursuit of creative ideas, but it also can make universities less easily focused than firms in pursuit of specific research goals.93 The highly concentrated nature of university patenting described above suggests that relatively few universities or faculty see pursuit of commercializable intellectual property as particularly important.

Fourth, research within a university is done in pursuit of tenure and prestige (awards, job offers, publications, etc.) rather than in (or perhaps in addition to) pursuit of financial rewards.94 Like everyone else, university-based researchers generally prefer greater to lesser financial rewards, but they know most university-awarded financial rewards likely pale compared to those of their counterparts who pursue research in private industry. They thus clearly value the other attributes of universities over those of for-profit firms sufficiently enough to give up some financial rewards.95

Finally, universities can be difficult for outsiders to navigate because they operate so differently from firms.96 Companies often complain about the problems of negotiating with universities.97 (Academics also complain about companies’ cultures.)98 To bridge the gap, commentators have identified a “strong need for individuals who can act as intermediaries or boundary spanners” between universities and businesses.99 As the president of the Maryland Technology Development Corporation testified, in support of the role of intermediary organizations like his, “the university culture is one of fairly complex and byzantine rules and regulations. Intermediaries help the entrepreneurs who have never even known the existence of tech transfer offices to understand what is going on, to help them understand what an express license is versus trying to negotiate on their own.”100 Universities’ organizational complexity and differences from the private sector increases the cost of commercialization efforts, making outsiders less willing to work with universities. Mitigating these transaction costs is important to try to expand commercialization efforts. However, such costs are desirable features, not bugs, for some in the university community. One example is the slower pace of decision making in universities due to shared governance; others include seemingly ever-expanding university bureaucracies that slow decision making. The slower pace or larger bureaucracies play important roles in securing support from constituencies within or important to universities.

In economic terms, we can think of the distinctive environment of universities as a series of constraints imposed on inventors’ plans to connect their research outputs to the economy. These constraints are not present (although different ones are) in private firms. These constraints raise the transaction costs of doing business with a university.101 But the constraints of university environments are not simply increased costs imposed by starry-eyed academics who fail to grasp the needs of the marketplace: The environment created in part by these constraints contains conditions for creativity that may enhance innovation. Firms – despite the many obstacles – contract with universities for research. This suggests the university environment offers something firms cannot buy elsewhere for a similar (or lower) price without incurring those transactions costs. In short, if universities were simply inefficient versions of the research environment that firms could create on their own, firms would have no need to contract with them. That firms contract with universities, faculty, and university-affiliated start-ups suggests that there is something valuable about the university environment and the researchers it attracts. This indicates that some research activities are best done through universities. One reason may be that universities are not just research laboratories: “[t]he differentiator for major research universities is the complementarity between teaching and research.”102 As we discuss below, there are reasons to think at least some universities may have a comparative advantage at some types of research.

C. Bayh-Dole & Incentives to Stimulate Research

Measuring research success is difficult. When a new idea is discovered, the future value is hard to know. Some inventions are not translated into success for some time and others, initially thought to be significant, fail to generate much revenue. One measure of university research output is the stock of inventions. In remarks on the Senate floor during debate over the 1980 Patent and Trademark Amendment Act, known as the Bayh-Dole Act after its cosponsors, Sens. Birch Bayh (D.-Ind.) and Robert Dole (R-Kan.),103 Bayh described a relatively simple, linear model as the framework for the Act: “Hundreds of valuable medical, energy, and other technological discoveries are sitting unused under Government control, because the Government, which sponsored the research that led to the discoveries, lacks the resources necessary for development and marketing purposes, yet is unwilling to relinquish patent rights that would encourage and stimulate private industry to develop discoveries into products available to the public.”104 The notion of good ideas sitting on the shelf of agencies for lack of investment reflected part of the problem but neglected the full context within which the translation of ideas from the academy to the world could occur. As Terence Kealey, who served as both a scientist at Cambridge and vice chancellor of the University of Buckingham, observes, the linear model did not match reality during the industrial revolution or today.105

Universities, which capture some rewards, have more incentive to commercialize the results of research than government bureaucracies do, but, as discussed above, they operate under a wider set of constraints than Bayh’s description suggested, which may help explain why so few successfully patent and transfer ideas. Moreover, “[t]he Act’s emphasis on patenting and licensing as a critically important vehicle for the transfer to industry of academic inventions lacked a strong evidentiary foundation at the time of its passage, and evidence on the role of patenting and licensing as indispensable components of technology transfer remain mixed.”106 There are plenty of ideas “on the shelf” produced at research universities but there are obstacles to getting them to the market for which Bayh-Dole’s linear model does not account. The supply of ideas that might be commercialized is only a partial answer to why firms would license university-produced ideas or buy university-related firms.

University research generally produces what Schumpeter termed inventions, rather than innovations. The distinction is that inventions alone will not have an economic impact without the transformational genius of the entrepreneur. As Schumpeter noted,

The inventor produces ideas, the entrepreneur ‘gets things done,’ which may but need not embody anything that is scientifically new. Moreover, an idea or scientific principle is not, by itself, of any importance for economic practice: the fact that Greek science had probably produced all that is necessary in order to construct a steam engine did not help the Greeks or Romans to build a steam engine; the fact that Leibnitz suggested the idea of the Suez Canal exerted no influence whatever on economic history for two hundred years.107

In Schumpeterian terms, what universities have to sell is just part of what is needed for an idea to succeed. To be useful in the marketplace, ideas must be manifested as designs, tools, methods, etc. that solve a problem or offer novelties previously unknown.108

Moreover, we need to keep in mind that licensing (or selling a firm with a license) is just one potential method of transferring knowledge from university to the market. As Litan, Mitchell, and Reedy argue,

Universities have a range of outputs, including information, materials, equipment and instruments, human capital, networks, and prototypes. The means by which these outputs are diffused, especially to industry, vary across universities. The Carnegie Mellon Survey of Industrial R&D found that the most commonly reported mechanisms for diffusion of public research to industry were publications, conferences, and informal exchanges. Patents ranked low in most industries except for pharmaceuticals.109

Idea transfers from universities to the world can occur independently of commercialization. Faculty generate papers, teach, consult, serve on boards, and so on – all means of knowledge transfer.110 Firms find value in these channels. A 2011 survey found the top two benefits reported by firms for interactions with universities were “access to fundamental understanding” and “access to direct assistance with problem solving.”111 An analysis of university strategies for interactions with firms therefore needs to incorporate channels besides commercialization. Over-estimates of the value of university-owned intellectual property can restrict faculty’s ability to pursue other avenues while fruitless commercialization efforts are made. Nonetheless, Bayh-Dole was created because these other methods were thought insufficient.

As discussed earlier, treating universities like profit-maximizing firms is a major conceptual error.112 Universities and firms operate under different legal and political constraints, actors within them face different incentives, and success is evaluated by different metrics both for the institutions and the researchers within them.113 Pathways for discoveries to move from university research to commercial development must account for those differences. As Gulbrandsen, Mowery, and Feldman (leaders in the academic study of technology transfer from universities to firms) wrote in their introduction to a symposium, “a recognition of the heterogeneity in the characteristics of university–industry linkages among disciplines is crucial to the formulation of intelligent public policy and for more effective management by universities of their relationships with industry.”114 This is challenging as “[p]ractice without process becomes unmanageable, but process without practice damps out the creativity required for innovation; the two sides exist in perpetual tension. Only the most sophisticated and aware organizations are able to balance these countervailing forces in ways that lead to sustained creativity and long-run growth.”115

If the fruits of university research are to make it to the marketplace, we need: (a) a variety of channels for the ideas to reach market actors, including means of commercialization, (b) a means of harnessing entrepreneurial talent from outside universities to innovations from within universities, and (c) methods that fit the unique environment within Coasian red boxes.

D. The University Environment & Innovation

As discussed above, the university environment differs from the environment of for-profit firms. The university is sometimes seen as the best environment for science, but not always.116 Both entities, though, require innovators to navigate inefficient bureaucracies. Just as the university environment can be challenging, the for-profit environment can also be difficult for innovators as firms too can have inefficient bureaucracies.117 At for-profit firms, innovators often struggle to adapt their method of project acceptance to the firm’s formalized process, causing problems for the organization. As Griffin, et al. noted in their study of “serial innovators” in firms, “the way in which they navigate the politics of project acceptance are so different from the firm’s formalized processes, they inherently cause problems for the organization.”118 Different incentive structures should mean that university researchers behave differently from researchers at for-profit firms. Although sarcastic, the account of a chemist hired away from academia by Dow Chemical in the 1920s (at twice his academic salary) in a letter to a friend written soon after the chemist started at Dow’s research laboratory captures the difference:

A week of the industrial slavery has already elapsed without breaking my proud spirit. Already I am so accustomed to the shackles that I scarcely notice them. Like the child laborers in the spinning factories and the coal mines, I arise before dawn and prepare myself a meager breakfast. Then off to the terrific grind arriving at 8 just as the birds are beginning to wake up. Harvard was never like this.119

In this section we discuss research on creativity and innovation that helps understand why the university environment should be productive for at least some kinds of research.

First, innovation requires creativity.120 As Richard Florida posits, creativity is “the faculty that enables us to derive useful new forms from knowledge.”121 Moreover, “creativity is often not just a single event or episode; it is sometimes an unplanned sequence of fortuitous events.”122 As a result, “creative success leads to further creativity, which helps to generate corporate funding to continue the work that initially did not appear to have potential—and frequently leads to business opportunities. . . . Working toward a goal can help creativity, but trying to predict or control the paths that link creative acts to useful results may do more harm than good.”123 It is thus a difficult force to control.

Second, we know that creativity is – contrary to popular perceptions of the lone genius toiling in a lab or studio124 – “heavily dependent on social interaction, which takes the form of face-to-face encounters and of immersion in the symbolic system of one or more domains.”125 Matt Ridley sums it up as “a collective, incremental and messy network phenomenon” and “a team sport.”126 As one scientist reported during an interview on the creative process:

Science is a very gregarious business; it’s essentially the difference between having this door open and having it shut. If I’m doing science, I have the door open. That’s kind of symbolic, but it’s true. You want to be all the time talking with people… it’s done by interacting with other people in the building that you get anything interesting done; it’s essentially a communal enterprise.127

Part of their value is surely that at least some universities are places where such “gregarious business” is relatively easy to conduct.

Third, we know that “[t]he most significant insights (e.g., those that lead to innovative new products or uses for new technology) are often characterized by a synthesis of information from multiple domains, which can be as far apart as chemistry is from social norms, or as close as neighboring branches of mathematics.”128 Ridley refers to this as “ideas having sex,”129 a metaphor that captures the environment in universities where ‘DNA’ from other fields is close at hand.

Fourth, there are “hot spots” as “access to the field is not evenly distributed in space. The centers that facilitate the realization of novel ideas are not necessarily the ones where the information is stored or where the stimulation is greatest.”130 These centers are “communities of practice” which are linked by “process and structure” to transfer knowledge, achieve scale, and generate growth.131 This is well-illustrated by a scientist’s description of the Berkeley chemistry department in 1930: “Successful research was the badge of honor. To not try to do research was unthinkable.”132 More broadly, Florida developed a theory to explain the success of cities due to the presence of a “creative class.”133 Although he focused on urban centers, he also contended that “Universities are the intellectual hubs of the creative economy. America’s vital university system is the source of much of our best scientific, social, and creative leadership.” Because they promoted talent and tolerance, as well as research, they too drew a creative class.134 These communities are also important because this is where tacit knowledge can be exchanged. Tacit knowledge plays an important role in transforming inventions into innovations.135 Universities often build clusters of faculty with related interests, making them into ‘hot spots’ for those fields.

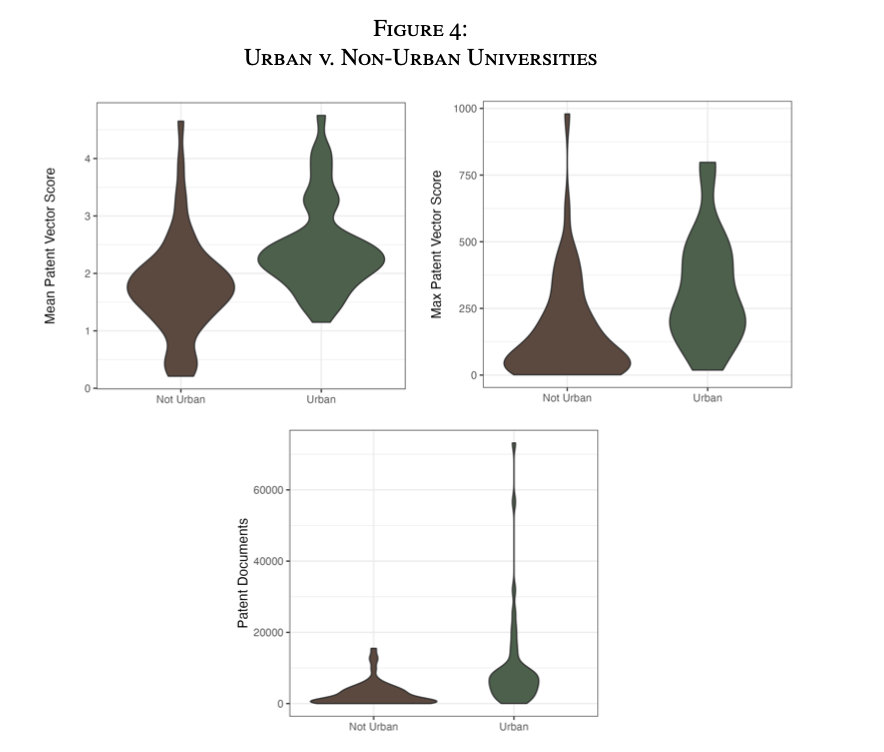

With our data, we find there is more high-value patent activity in universities in urban areas than those in non-urban areas, which might be due to an effect akin to Florida’s “creative class” argument. Figure 4 shows the patent data broken down by urban/non-urban, with quite different patterns of patenting.

Although universities in non-urban areas, particularly large ones, create their own community of creative individuals, it may be that with respect to the specific types of creativity necessary to transform research into marketable intellectual property (a subset of entrepreneurial abilities), the lack of a sizeable urban center is problematic.

Fifth, individuals differ in creativity. Research suggests that individuals who have strong intrinsic motivation are more creative, and giving these individuals the freedom to explore ideas is also important.136 People must also be curious to be creative: “Without a good dose of curiosity, wonder, and interest in what things are like and in how they work, it is difficult to recognize an interesting problem.”137 They need to be able to engage in both divergent and convergent thinking138 and be able to engage in the “hard work” that is “necessary to bring a novel idea to completion and to surmount the obstacles a creative person inevitably encounters.”139 Creative people have different powers of attention.140 They also need to be able to discard bad ideas.

Practically all creative individuals say that one advantage they have over their peers is that they can tell when their own ideas are bad, and that they can immediately forget the bad ideas without investing too much energy in them. Linus Pauling, the winner of two Nobel prizes, was asked at his sixtieth birthday party how he had been able to come up with so many epochal discoveries. “It’s easy,” he is said to have answered, “You think of a lot of ideas, and throw away the bad ones.” To be able to do so, however, implies that one has a very strong internal representation of which ideas are good and which are bad–a representation that matches closely the one accepted by the field.141

Moreover, some people are better at identifying and solving problems that demand creative solutions, where “the nature of the problem to be solved is less clear; in fact, the problem itself might not be formulated until the moment of insight.”142 Identifying such problems is a key challenge.143 If universities are better than firms at attracting individuals with these skills, then universities will have a comparative advantage in producing creative ideas. Further, the hiring of creative people is not something that ever ends: talent is not a stock but a flow.144 Hiring processes must therefore focus on continually replenishing the flow. University hiring processes are generally driven by departments and so focused on excellence in particular fields, a focus which is likely to keep the flow moving.

Sixth, there must be an environment that fosters creativity for researchers,145 a part of the analysis of creativity that has often been neglected.146

Based on what we now know about creativity, this is what managers should do to foster creativity in organizations. First, they should work to eliminate the environmental obstacles—the turf battles, the caustic reactions to new ideas, the lack of commitment to innovation. Second, they should create an environment where the stimulants are richly, redundantly present: an orientation toward innovation and risk taking, from the highest levels of top management on down; strategic direction for projects, coupled with procedural autonomy for those doing the projects; work that people perceive as challenging, interesting, and important; rewards and recognition for creativity; frequent, work-focused feedback; stimulating, diverse work teams; open communication and collaboration across the organization; and commitment of adequate resources and time for projects.147

While universities can be far from ideal in this regard, with disciplinary barriers, rigidity in existing conceptions of disciplines, and barriers to collaboration that range from the relatively mundane (parking) to deeply problematic (tenure standards that discourage cross-disciplinary work),148 they can also be good places for creative work. One key advantage is that universities house smart, creative people from a variety of fields. This is important as a critical part of the creative process is interaction with people in “neighboring fields.”149

The freedom of the university environment is also an important ingredient in this environment.150 Indeed, Ridley says that freedom generally is the “secret sauce” that produces innovation: “[f]reedom to exchange, experiment, imagine, invest and fail; freedom from expropriation or restriction by chiefs, priests and thieves; freedom on the part of consumers to reward the innovations they like and reject the ones they do not.”151 This is not just the ability to choose an area of research but something broader. Creativity researchers identified “an environment where project goals are clear, challenging, and personally interesting, where they are given autonomy in deciding how to achieve project goals, where their new ideas are met with encouragement and enthusiasm, where they are not burdened with impossible project schedules or resource limitations” as important to fostering creativity.152

Finally, approaching the problem from the other end, Csikszentmihalyi and Sawyer argued that creativity is unlikely to be found where any of the following conditions are met:

● “The absence of a strong interest, curiosity, or intrinsic motivation that drives the person to commit attention to a problematic area in a domain. A person who is not intrinsically motivated has no incentive to push beyond generally accepted boundaries of knowledge.

● The absence of a thorough grounding in at least one symbolic domain, presumably as an apprentice to an expert, and not having experienced the colleagueship of other expert apprentices. Creative insights typically involve the integration of perspectives from more than one domain.

● The absence of interaction with other individuals who are experts in the domain or in potentially relevant other domains. At every stage of the process, the stimulation and feedback of peers is necessary to select and evaluate potential insights.

● A schedule in which a person is always busy, goal-directed, involved in conscious, rational problem-solving. Incubation is facilitated by periods of idling, leisure, and involvement in activities such as walking, gardening, driving (i.e., activities that require some attention but are automated enough to permit subconscious processes to work just below the threshold level of awareness).”153

The barriers they describe are less likely to be present within universities. Universities thus have some comparative advantages in hiring people likely to produce creative solutions to problems. This provides an incentive for firms to harness that human capital to solve problems or to purchase the results of faculty research.

E. The Results of Innovation in Universities

Most university research falls into two of the types of innovation Schumpeter described in The Theory of Economic Growth: (1) “The introduction of a new good—that is one with which consumers are not yet familiar—or of a new quality of a good”; and (2) “The introduction of a new method of production, that is one not yet tested by experience in the branch of manufacture concerned.”154 These innovations require skills he attributes to entrepreneurs: “doing of new things or the doing of things that are already being done in a new way.” There is considerable opportunity to do “new things” or do things “in a new way” as a result of university-related research. As a result of outside research funding, which grew substantially in the United States after World War II primarily from federal sources, university researchers sought to both help solve specific problems (produce new technologies for defense, etc.) and foster the development of basic science. This built on a tradition of public investment in practical research, starting with the Morrill Act and the creation of the land-grant university system.155

University researchers regularly make contributions to industry,156 although as noted earlier, it is only a small minority of universities that do so. Such research is an important source of “key ideas” in many industries, “ideas that generate significant technological opportunities through fusion of knowledge of what’s doable with knowledge of what needs to be done.”157 It also makes important indirect contributions from areas outside a given industry.158 A survey of Advanced Technology Program projects suggested that industry invites universities into research projects that “involve what we have called ‘new’ science. Industrial research participants perceive that the university could provide research insight that is anticipatory of future research problems and that it could be an ombudsman anticipating and communicating to all parties the complexity of the research being undertaken.”159 Universities also produce inventions that “could not be developed independently by either the inventor or the firm.”160

One differentiator for university-based research is that the results are generally “done” –from the point of view of the university – at an earlier stage than much commercial research.161 As Jensen and Thursby put it, “when they are licensed, most university inventions are little more than a ‘proof of concept.’”162 Early-stage results are less certain to become commercial products – that is, they carry greater uncertainty about both their technological and commercial potentials. They are riskier investments than ideas from later-stage research.163 As a result, they are “fraught” with incentive problems and so are difficult to contract about. Licensing agreements are more time-consuming to conclude for early-stage status.164 In brief, the investments needed to commercialize embryonic research from universities have three basic characteristics:

1. the investment is substantially sunk and is rarely recouped;

2. the technical and market uncertainties may diminish as information becomes available about the technology; and,

3. the opportunity to invest is generally not completely dissipated by competition among rivals.165

These characteristics create incentives for market-driven investors to delay investments.166 The slowness of development makes valuation difficult167 and requires additional investment to bring products to the manufacturing stage.168 Commercialization depends in large part on the university’s ability to reduce commercial risk, which is more likely when there is a market “pull,” the invention has become technically feasible, and production is predicted to be cost-effective.169 As discussed below, these are difficult risks for early stage technologies.

What is missing from a university invention awaiting commercialization is what the entrepreneur brings to the table. As a result, connecting university research ideas to business partners is widely recognized as a critical step in enabling the ideas to have an impact. As one tech transfer expert put it, “if we can’t get a commercial partner, those good ideas are going to sit on shelves.”170 Finance for development is a necessary but not sufficient part of the solution. As economist Fritz Machlup noted in his 1958 analysis of the patent system, the incentive provided by the patent monopoly generally is intended to motivate the additional investment to bring ideas to market: “Financing the work that leads to the making of an invention may be a relatively small venture compared with that of financing its introduction, because costly development work, experimentation in production and experimentation in marketing may be needed before the commercial exploitation of the invention can begin. The risks involved may be too great to be undertaken except under the shelter of a monopoly grant.”171 These risks are greater when much of the research comes from universities, due to the early stage of development. Giving patent rights to universities provides rewards long before much of the work is done, which is a potential problem with the Bayh-Dole model.

Moreover, a related major challenge with the ideas coming out of universities is that “new information tends to be produced in tacit form, increasing in tacitness as a function of distance from prior knowledge…. Tacit knowledge tends to be highly personal, initially known only by one person (or a small team of discovering scientists) and is difficult to transfer to others.”172 Universities do well at producing tacit knowledge that can be an advantage in commercialization because greater tacitness offers greater opportunities by providing a firm with a competitive advantage.173 However, greater tacitness also requires greater participation by faculty (who have the tacit knowledge) in further development of the research.174

F. The Challenge of Incentivizing University Invention

Some politicians saw the research produced in universities as a potential economic development tool. Through a combination of aligned interests and personality-based politics, the primary legal framework became vesting ownership of intellectual property rights arising from federally-funded research in universities via the Bayh-Dole Act.175

Bayh-Dole promised to unlock technological treasures that federal agencies funded but failed to push into the marketplace. By some measures, the statute is a success: it dramatically increased the number of patents awarded to universities, university-related start-up companies, and licenses from universities to outside entities for faculty-developed technologies.176 In 2002, The Economist praised Bayh-Dole for creating incentives to invest private money “to turn a raw research idea into a marketable product” rather than allowing ideas of university researchers to be left “in warehouses gathering dust.”177 The then-director of the Wisconsin Alumni Research Foundation, the oldest and one of the most successful of the entities focused on commercializing university research, praised it for stimulating partnerships between government, universities, and start-up firms, and claimed that almost a third of the value of the NASDAQ (in 2007) came from university-based, federally-funded research.178 Further, an evaluation of time-to-market found a faster translation of research to market in 1986-1994 relative to 1975-1984, which could reflect improved commercialization or greater emphasis on applied research by universities.179 Not everyone sees the statute as a complete success: some studies of the value of the increased patents concluded that average quality was lower due in part to increased patenting of “losers”—patents that receive zero subsequent citations.180

Bayh-Dole’s approach, and the claims made for it, focus on the development potential of inventions stuck behind a wall of federal red tape combined with a more straightforward model of how research investments could turn ideas into marketable products. This approach neglects the Schumpeterian insight that this is not a linear or simple process. We need to appreciate “how multiple, unevenly paced, and nonlinear are the paths between scientific discovery and new technology.”181 What is needed is not just investment (although often quite a lot is needed) but what Schumpeter called the “creative response.” He distinguished that from the managerial “adaptive response” in three ways:

First, from the standpoint of the observer who is in full possession of all relevant facts, it can always be understood ex-post; but it can practically never be understood ex-ante; that is to say, it cannot be predicted by applying the ordinary rules of inference from the pre-existing facts. This is why the ‘how’ in what has been called above the ‘mechanisms’ must be investigated in each case. Secondly, creative response shapes the whole course of subsequent events and their ‘long-run’ outcome…. Creative response changes social and economic situations for good, or, to put it differently, creates situations from which there is no bridge to those situations that might have emerged in its absence. That is why creative response is an essential element in the historical process; no deterministic credo avails against it. Thirdly, creative response—the frequency of its occurrence in a group, its intensity and success or failure—has something, be that too much or little, to do (a) with quality of the personnel available in a society, (b) with relative quality of personnel, that is, with quality available to a particular field of activity relative to quality available at the same time, to others, and (c) with individual decisions, actions, and patterns of behavior. Accordingly, a study of creative response in business becomes coterminous with a study of entrepreneurship. The mechanisms of economic change in capitalist society pivot on entrepreneurial activity.182

We argue that university researchers often produced research results that were candidates for leading to a “new thing” or a “new way of doing things” because conditions gave university-based researchers more freedom in their research. However, this boost to creating good ideas was not without its costs. This enhanced potential makes translating the idea into the marketplace a greater challenge because the research demands financial investment, additional intellectual development, and, crucially, entrepreneurial talent to make that transition. Such investments require costly contracting to accomplish, given the early stage of most university-connected ideas. Such contracting is difficult for universities reliant on general counsel offices that lack sophisticated IP legal talent in the private sector.183

The most difficult input is entrepreneurial talent. Schumpeter thought entrepreneurial skills were in short supply: “It is in most cases only one man or a few men who see the new possibility and are able to cope with the resistances and difficulties which action always meets with outside of the ruts of established practice.”184 The challenge for universities wishing to see researchers’ ideas take root in the economy is to find how to connect the opportunity an idea offers with financial capital and entrepreneurial skill.

II. How Universities Commercialize Research

Universities have changed how they approach research commercialization as a result of Bayh-Dole. Understanding this helps us assess the current process and how it might be improved, as well as understanding the impact of recent changes to universities.

A. The Institutional Context

Formal university commercialization efforts started with the University of Wisconsin’s rejection of a faculty member’s offer of an invention to the university based on legal advice that the university could not spend state resources on patenting an idea. Prof. Harry Steenbock then created the Wisconsin Alumni Research Foundation (WARF) and assigned his invention (a way to increase the vitamin D content of food) to it in 1925. The invention was a success and WARF brought in millions of dollars.185 WARF later pioneered agreements with the federal government allowing Wisconsin to take title to patents based on research funded by agencies.186 That success served as a model for the Bayh-Dole Act.187

Among the goals of Bayh-Dole were to reduce the complexity would-be commercializers faced in dealing with agency licensing procedures, to clarify who held rights to patents, and to place ownership where there would be an incentive to license.188 University patenting increased dramatically.189 The number of TTOs increased from 25 at the time the statute was passed to 3,300 twenty-five years later.190 As Litan, Mitchell, and Reedy noted, TTOs “were the product—more than likely the unintended consequence of” Bayh-Dole.191

AUTM, formerly the Association of University Technology Managers, which has an interest in portraying the outcome of Bayh-Dole as favorable, estimated in 1999 that academic licensing of technologies led to $33 billion in economic activity and 280,000 jobs in the United States.192 A study commissioned by the National Academy of Engineering more modestly claimed that the impact of academic research on the medical device, financial services, and network systems and communications industry had been “large” and the impact on the transportation, distribution, and logistics and aerospace industries had been “moderate.”193 There is evidence that faculty entrepreneurs are highly cited and productive, suggesting that entrepreneurial activity need not reduce academic achievement.194 However, the effects differ across fields.195

Bayh-Dole spurred a focus on patenting by universities.196 This alone may be a benefit of the statute, even with respect to traditional views of the role of the university, as some research suggests patents are a reaffirmation of the originality of a scientist’s work.197 Azoulay, Ding, and Stuart argue that “patents and publications correspond to two types of output that have more in common than previously believed” and “encode similar pieces of knowledge.”198 Agrawal and Henderson’s study of two MIT departments found considerable differences between publications and patents.199 Specifically, faculty who patented also published work with more impact. Similarly, Magerman, Van Looy, and Debackere analyzed biotechnology patent-paper pairs and found no negative citation effects associated with patents.200 Papers associated with a patent received more citations, leading them to conclude that “patenting does not jeopardize one’s scientific footprint.”201 Patent rights may be “necessary to drive commercialization, particularly in the biomedical context,” because turning an idea into a product requires large investments.202

Fans of the statute argue that it gives university researchers an incentive to push ideas into the marketplace, enabling them, and society, to reap the rewards that come with patent licensing.203 Hellman suggests a model that yields a “science to market gap” in which firms are unaware of what scientific discoveries might meet their needs.204 This is bridged by communication between researchers and firms–which is encouraged by patenting’s incentive to researchers to push discoveries out to industry–with TTOs serving as the agents.205 How much this has succeeded is not clear, although data on university patents suggests it has not succeeded outside of a small subset of universities: one report suggested that 95 percent of university patents are unlicensed.206 If true, this signals a weakness in either (or both) the process or the value of the research pursued.

Not everyone cheers the focus on intellectual property, commercialization and the creation of TTOs. Critics challenge the reliance on exclusivity in licensing. Nelson argues that companies are willing to invest without exclusive rights to university-developed research because they anticipate being able to patent their own improvements and so reap rewards.207 Others raise concerns that increased patenting based on university research leads to an “anti-commons” in which a patent thicket slows or blocks future research.208 Empirical research suggests there is little evidence that patent licensing blocks research (in part because academic researchers often ignore patents) but there is evidence that materials and data access agreements pose problems.209 Eisenberg, one of the main proponents of the anti-commons interpretation, explained this to be the result of the high transaction costs of enforcing patents against researchers and the low transaction costs of denying researchers access to materials and data unless they agreed to restrictions on use.210

Other critics raise concerns about universities using patents “not for purposes of fostering commercialization, but instead to extract rents in apparent holdup litigation.”211 Some argue that university TTOs focus on short-term ‘lottery’ patents to get the quickest payback, over long-term investments in ideas that may have greater potential.212 Others claim that a focus on commercialization steers universities away from their proper role in society,213 and some contend that commercialization prioritizes applied research over the traditional goal of pure knowledge.214 Some are concerned that commercialization will restrict communication among scientists.215 The NAE study cautioned that commercialization efforts raise questions about whether “the entrepreneurial university and the new interest in financial gain are distorting the traditional values, goals, and the identity of the university with negative consequences.”216 These concerns are not merely rhetorical: there is evidence that publications associated with patents lead to slower rates of forward citations.217 Backward citations in industrial patents are increasing as university patenting increases, suggesting “a slowdown in the pace of firm knowledge exploitation.”218

Commercialization may be beyond the ability of universities. They may not be able “to adapt to, to articulate, and to pursue new directions in basic and applied research and training” to keep up with industry needs “while continuing to jump-start new areas of basic, long-term research and generate the key ideas that will provide the foundation for tomorrow’s industries.”219 More generally, Bayh-Dole has been criticized as a “poorly targeted institution” because intellectual property rights are “a blunt and costly mechanism for facilitating technology transfer from the government to industry when compared to alternatives.”220

There seems to be little empirical support for the sharpest criticism of university focus on TTOs and commercialization.221 There is evidence that licensing has not shifted university research away from basic research and that licensing promotes additional basic research.222 Azoulay, Ding, and Stuart found that “patenting is often accompanied by a flurry of publication activity in the year preceding the patent application, even after accounting for the lagged stock of publications” and, controlling for scientist-fixed effects, suggest that “surges of scientific productivity, not steady research performance, is most likely to be associated with patenting,” a finding they interpret to mean that “uncovering of new, productive areas of scientific inquiry is an important precursor to the act of patenting.”223 They also found a relationship between what they term the “latent patentability” of faculty research and the propensity to patent, having derived the former from a keyword analysis of publications of scientists already patenting in the same area.224 Thursby and Thursby found recent disclosure activity had an overall positive impact on both public and private faculty research funding and publication rates.225

Much of the university interest is, of course, about money. A 2000 review of the literature on university-industry partnerships found that university motivations were “largely financially based” while industry motivations focused on “access to complementary research activity and research results” and “access to key university personnel.”226 Despite the creation of many TTOs, commercialization efforts did not produce a financial windfall, which is unsurprising when we take into account how few universities are patenting extensively or patenting high value ideas. Reinforcing our conclusions from the patent data, one study of 2012 data found 130 of the 155 universities reporting data did not cover expenses for the year.227 Another concluded that “[v]ery few university ‘inventions’ garner significant license incomes. . . . Many universities are [likely] paying significantly more to run their patenting and licensing offices than they are bringing in license revenues.”228 One survey found that the top five inventions licensed by each university accounted for 78 percent of gross licensing revenue.229 Litan, Mitchell, and Reedy concluded that “[t]his is not an outcome one would expect from a nation rich in scientific talent at many universities” while Aldridge and Audretsch claim that the “paucity” of university start-ups post-Bayh-Dole is “startling and disappointing.”230 The dominance of a few patents should not be a surprise. At many firms, a few key products dominate revenue streams. However, maintaining money losing TTOs is another matter.231